Charge and you can Expenditures

But not, of a lot 401(k) preparations costs origination and you can quarterly repairs fees, while loans from banks typically do not. So it consolidation generally speaking decreases the attractiveness of 401(k) fund. Particularly, these charge dramatically boost the cost of small 401(k) finance.

The outcome away from charges with the crack-also financing come back is exhibited inside the Table 4. Good $20,000 loan that have an industry speed of eight % features a beneficial eight.5 % break-actually resource return if improvement is triggered a good 401(k). The break-actually falls to 6.8 per cent when the improvement is dedicated to a checking account. When the a $75 origination payment and you will an effective $thirty-five yearly repairs commission come, the vacation-actually falls to help you six.step three percent. Shed the borrowed funds add up to $dos,000 additionally the split-also falls to help you 2.4 per cent. A mix of 401(k) loan fees and you will brief financing proportions significantly reduces the attractiveness of 401(k) loans. 3

Most other Considerations

Deciding whether to receive a good 401(k) financing involves a glance at many other advantages and drawbacks relevant with the help of our money. 4 Earliest, there is no credit score assessment which have 401(k) loans, which makes them more attractive to individuals with poor credit. At exactly the same time, individuals with less than perfect credit are generally energized highest rates whenever making an application for a traditional loan; this is simply not the outcome which have an excellent 401(k) loan. Another advantage to 401(k) fund is the efficiency. Fundamentally, a short means is actually published to new employer and mortgage costs are subtracted about borrower’s paycheck.

A life threatening disadvantage is when good 401(k) loan isnt repaid, the newest a good number is stated into the Internal revenue service just like the a shipments in addition to borrower need to pay normal taxation in addition to a 10 % very early withdrawal penalty whether your debtor is actually more youthful than simply years 59?. The potential for standard increases if there is business loss. A loan away from an excellent 401(k) must be repaid entirely in this 90 days just after a job ends, and/or loan is within standard. As well as, possessions during the senior years arrangements is actually safe for the case of bankruptcy. People that get deal with bankruptcy would not want to deplete safe assets. A good 401(k) loan try a negative option for someone facing work losses otherwise possible case of bankruptcy.

Achievement

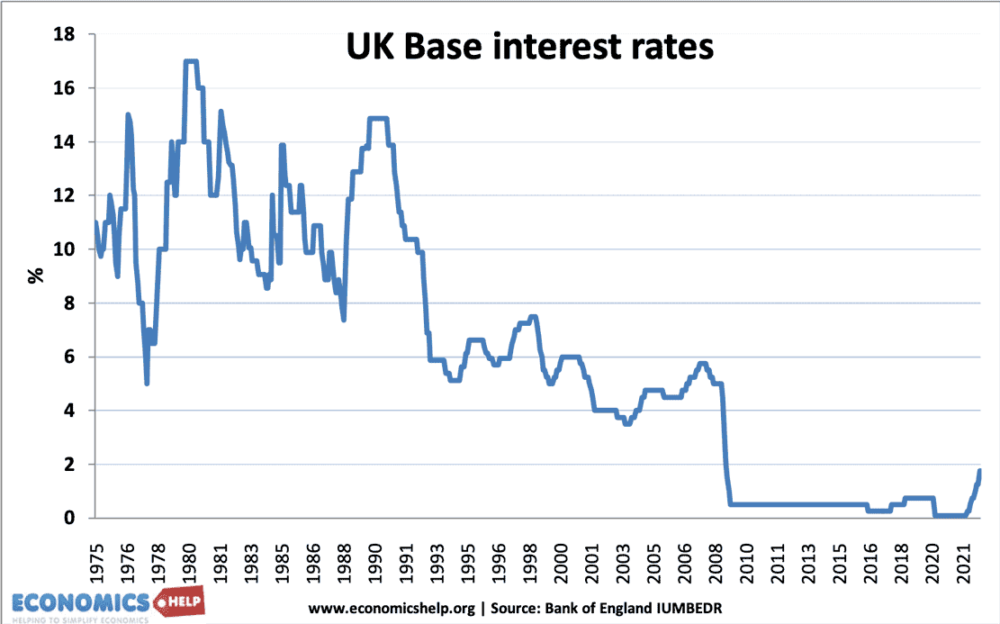

Whenever borrowing is actually unavoidable, a good 401(k) loan may be the best suited alternatives lower than three problems. Very first, in the event the simply solution is high interest rate debt, good 401(k) loan will be the greatest choice. A get back to a high interest environment much like the early mid-eighties would make 401(k) financing more desirable to all the qualified professionals. Charge card or any other high rate of interest financial obligation will make 401(k) funds popular with some one saddled with these types of debt. Next, a great 401(k) mortgage tends to be better if expected funding output are reduced. For example, an individual that have low-price fixed-income financial investments within his or their unique 401(k) are better off credit the cash to help you himself/by herself through an effective 401(k) financing. 3rd, the new 401(k) financing will be the only choice when you have poor borrowing from the bank or people who are liquidity constrained.

Good 401(k) mortgage isnt the right choice significantly less than several scenarios. The modern low interest rate ecosystem tends to make 401(k) fund less glamorous. In addition, with good credit and www.paydayloanalabama.com/newville you will use of home guarantee funds allow of many in order to acquire at reasonable cost that produce 401(k) money shorter aggressive. A beneficial 401(k) mortgage try a poor alternatives when the most other lowest-speed personal debt can be found. Good 401(k) financing is also a challenging choices whenever origination and you may restoration charge are required as well as the total feel lent try brief. Ultimately, borrowing outside an effective 401(k) bundle try preferable when investment productivity are essential to get highest or whenever individuals could possibly get eradicate their jobs or file case of bankruptcy.