While many anybody representative the fresh new You.S. Service out of Farming (USDA) with agricultural assistance, the latest USDA now offers an invaluable home loan system which may surprise your. Even in the event often regarded as providing solely to farmers and rural people, the fresh USDA Home loan Program is a flexible and you may beneficial choice for to order otherwise refinancing solitary-family land within the eligible parts.

What’s the USDA Mortgage Program?

The fresh new USDA Financial, commercially known as the USDA Outlying Development Secured Homes Financing System, is designed to help homeownership in outlying portion by giving sensible resource possibilities. Instead of conventional mortgages, this method emphasizes rural advancement, looking to improve monetary gains and you can increase lifestyle conditions throughout these groups.

Advantages of the fresh new USDA Mortgage Program

- No Down payment: One of several standout popular features of the fresh USDA Mortgage ‘s the not enough a down-payment demands. Eligible consumers can loans up to 100% of one’s house’s cost, so it is an appealing choice for individuals who may not have significant savings for a downpayment.

- Competitive Interest rates: This new USDA Mortgage normally now offers down rates as compared to old-fashioned funds. This leads to nice discounts along the longevity of the brand new financing.

- Versatile Borrowing Criteria: While conventional mortgage loans will often have tight credit score standards, the fresh new USDA Mortgage system is far more lenient. They considers items for example fee record and loans-to-money ratio, which will make they offered to a bigger range of consumers.

- Zero Personal Home loan Insurance rates (PMI): In the place of PMI, this new USDA Financial demands individuals to pay an initial verify fee and you will a yearly commission. This type of fees keep the program’s durability consequently they are usually below PMI can cost you.

- Service to own Household Fixes: New USDA Mortgage system along with lets borrowers to incorporate the purchase price off required fixes and improvements within amount borrowed. This might be such as for instance useful those to acquire installment loans Colorado fixer-uppers.

The historical past of USDA Outlying Houses Solution

The new USDA, created in the fresh new late 1800s, released the Rural Houses Provider into the 1991. Donalsonville, GA, try the initial area to profit out of this solution, which includes due to the fact stretched all over the country. Just like the the first, the program keeps triggerred domestic sales for about step one.5 mil citizens, which have step one.1 million ones transactions occurring due to the fact 2009.

Simple tips to Determine if a USDA Mortgage is right for you

The new USDA Home loan features specific income constraints centered on family size and you may venue. Use the USDA’s money qualification tool to find out if your qualify.

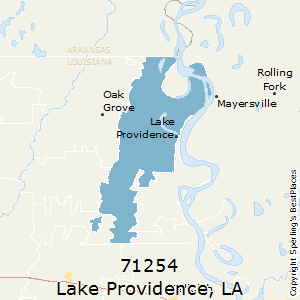

The house or property need to be situated in an eligible outlying city. Utilize the USDA’s on the internet chart equipment to check in the event your desired place qualifies. On the other hand, the house or property need certainly to satisfy specific top quality criteria.

Loan providers will opinion the debt-to-money ratio, and therefore measures up the month-to-month debt money with the terrible monthly income. A lower life expectancy proportion improves your chances of qualifying getting an excellent USDA loan.

Prepare needed data files instance proof money, evidence of assets, a job records, and you can credit history. These will be required when you look at the application process.

Get in touch with a great USDA-recognized financial first off the job. The financial institution have a tendency to make suggestions from techniques, comment your own papers, which help your finish the papers.

Pros and cons of USDA Mortgage System

- Zero advance payment called for

- Competitive interest levels

- Flexible borrowing from the bank conditions

- No PMI

Achievement

This new USDA Mortgage Program now offers an alternate path to homeownership for those who work in qualified rural parts. Featuring its zero-down-commission criteria, competitive prices, and flexible borrowing criteria, it may be an effective option for many borrowers. Of the very carefully determining their qualification and you may understanding the program’s masters, you might decide if a good USDA Mortgage ‘s the best selection for you. As always, speak with an experienced financial elite to understand more about your capital choice making the best choice.