Month-to-month Mortgage repayment

Your own mortgage repayment to have an effective $222k household could well be $step 1,480. This is predicated on an excellent 5% interest rate and an effective ten% advance payment ($22k). For example projected assets taxes, threat insurance, and you can financial insurance costs.

Earnings Necessary for a great 200k Home loan

You really need to generate $74,006 per year to cover the a good 200k financial. I ft the money you want to the an excellent 200k mortgage on the a payment that’s 24% of one’s monthly money. For you personally, your own month-to-month earnings should be about $6,157.

You may are more conventional otherwise an excellent bit more aggressive. You can easily change so it within exactly how much house ought i manage calculator.

Make Test

Use this fun test to determine exactly how much Eckley CO no credit check loans household We can afford. It takes merely a few momemts and you will certainly be able to comment a personalized comparison in the bottom.

We shall make sure to commonly overextending your financial budget. You will possess a gentle amount in your savings account once you purchase your property.

You should never Overextend Your budget

Banking institutions and you can real estate agents make more money once you purchase a very high priced family. Normally, banking institutions usually pre-accept your for that you can maybe manage. Out of the door, first traveling house, your finances could be longer on maximum.

It is essential to ensure that you is actually confident with your own payment therefore the amount of money you should have left in the your money after you purchase your family.

Examine Mortgage Costs

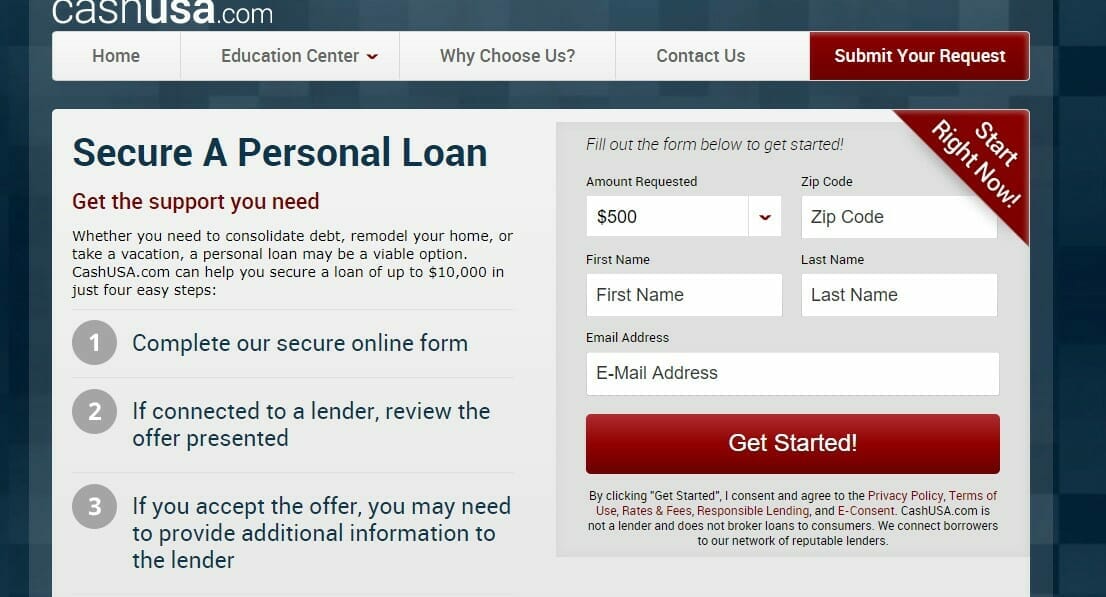

Make sure you evaluate financial prices before applying having good financial loanparing step three lenders can save you several thousand dollars during the the first few many years of your mortgage. You might evaluate financial prices into the Plan

You can find most recent mortgage rates otherwise observe mortgage rates now keeps trended over last few years with the Package. We screen every single day financial costs, fashion, and you will dismiss facts having fifteen year and you can 30 12 months home loan points.

- Your credit score is an important part of the financial processes. For those who have a leading credit history, you have a much better threat of getting a accepted. Loan providers are certainly more comfortable providing you with home financing payment you to are a more impressive part of the month-to-month earnings.

- Property owners connection charges (HOA charge) can impact your residence to get energy. If you choose a home that has large connection charges, it indicates you’ll need to favor a lower life expectancy valued the home of to help you decrease the dominant and focus percentage adequate to render area toward HOA expenses.

- Your almost every other obligations payments make a difference your property finances. If you have lower (or no) most other mortgage costs you really can afford to visit a tiny higher on your own mortgage repayment. For those who have highest monthly installments some other funds including automobile money, college loans, or playing cards, you will have to back down your monthly homeloan payment a small to ensure that you feel the funds to pay all of your current debts.

A long time ago, you had a need to generate a good 20% advance payment to pay for a property. Now, there are many different mortgage items that enables you to create a good far shorter down payment. Here you will find the advance payment criteria to have well-known mortgage factors.

- Conventional fund require a 5% down payment. Certain first time homebuyer programs allow it to be step 3% down costs. One or two instances was Home In a position and you can Domestic Possible.

- FHA funds require good step three.5% down payment. So you can qualify for an FHA mortgage, the house you are purchasing should be most of your home.

- Virtual assistant funds need a beneficial 0% advance payment. Effective and retired army personnel is generally entitled to a Va financing.

- USDA money need an effective 0% down payment. These are mortgages that exist when you look at the rural areas of the country.

Do you know the strategies to purchasing a property?

- Mess around with many mortgage hand calculators. Begin getting confident with all the costs associated with buying a beneficial home. Many people are surprised once they observe much most property taxes and you may home insurance increases their payment every month.

- Look at the credit score. Many financial institutions have a tendency to now direct you your credit score free-of-charge. You’ll be able to use an app for example borrowing karma.