A cash-aside re-finance is going to be just the thing for homeowners who possess collected specific security in their assets and want accessibility cash. When you yourself have a keen FHA financial, you to definitely their safest alternatives is to try to re-finance to a different FHA financing. Being qualified for an FHA dollars-out refinance is extremely exactly like being qualified to suit your unique FHA financial, so most property owners get the strategy to getting very straightforward. We have found all you need to find out about a keen FHA dollars-away refi.

What is actually a keen FHA cash-out refinance?

An FHA cash-aside refinance are a different sort of mortgage that takes care of their totally new mortgage harmony and you may replaces your debt. Together with replacement their original mortgage, the fresh FHA mortgage provides you with a cash payment. Your mortgage harmony is larger than their previous balance, however have the difference in dollars.

Homeowners choose for dollars-aside refinances for a variety of explanations. Make use of the amount of money from the re-finance to do a big resolve otherwise renovation. Some may require the money to cover tuition otherwise a beneficial medical statement. Because the FHA dollars-aside re-finance costs are typically less than costs for personal loans or other kinds of personal debt, a profit-aside refinance are an installment-efficient way to view dollars.

Who qualifies to own an FHA cash-aside refinance?

Certain requirements having acceptance to possess an FHA dollars-aside re-finance act like the prerequisites for the original FHA mortgage. However, you may have to satisfy some most certification.

The minimum credit score importance of a keen FHA dollars-away re-finance is 580, but you will score a very favorable rate of interest with increased get. You will need certainly to inform you proof of consistent work and you may income. In most cases, the maximum financial obligation-to-earnings ratio the fresh FHA allows try 43%, for example no more than 43% of one’s earnings is going into the housing costs or any other debts.

You really need to have stayed in your house for around a season ahead of being qualified to own a funds-aside refinance towards the FHA. You probably is refused an enthusiastic FHA re-finance if you’ve actually ever overlooked a home loan commission.

The past key factor on your approval is the financing-to-value ratio, and that compares the balance of your home loan towards the worth of your home. The loan-to-really worth proportion cannot be over 80%, and that means you have to have at the least 20% security of your home to qualify for a funds-out re-finance.

2022 FHA cash-away refinance limitations

The requirements and you will words to possess FHA funds alter from year to year, it is therefore important to discover right up-to-big date suggestions before you go the application. Your home loan is also add up to doing 80% of one’s home’s appraised well worth, thus mortgage constraints are normally taken for resident to help you citizen.

not, the FHA does place a max financing well worth for all individuals. In the most common metropolitan areas, the brand new maximum for unmarried-loved ones land try $420,680. From inside the highest costs-of-living components, although, the new restriction to own unmarried-relatives belongings try $970,800. You need the fresh Institution from Housing and you may Metropolitan Development’s site to look for FHA financial constraints near you.

The new FHA plus sets limitations to own multiple-family unit members qualities. For the 2022, mortgage constraints for duplexes are ready so you can $538,650 from inside the affordable-of-traditions portion and you will $step one,243,050 to own high cost-of-way of living parts. The new limitations having triplexes and five-plexes is a bit large.

Positives and negatives off an FHA cash-out refinance

Refinancing your home is a major economic choice. You ought to weighing the huge benefits and drawbacks ahead of completing your application. The primary benefit to an earnings-out refi is the influx of cash you’re going to get since mortgage was finalized. Homeowners who have a lot of guarantee in their home could possibly get a large cash percentage in the a competitive interest.

FHA bucks-away re-finance prices are usually much lower than simply prices private finance and you may handmade cards. Also will below interest levels to own household security funds. If you like usage of cash, a profit-away re-finance is the least expensive financing choice.

One major downside to any form away from refinancing is you must pay closing costs out-of-pouch otherwise move them to the the fresh mortgage balance. Settlement costs can add up to several thousand dollars, so you should guarantee this new coupons additionally the dollars commission can be worth the excess expense.

Having a keen FHA cash-out refi, you happen to be and credit more than you currently owe. Whilst you is also place the bucks so you can good have fun with, you do have to repay it with desire. Enhancing the equilibrium of the home loan because of the a substantial count normally increase your payment per month otherwise increase the latest lifespan of your own financing.

Just how to make an application for an enthusiastic FHA dollars-aside refinance

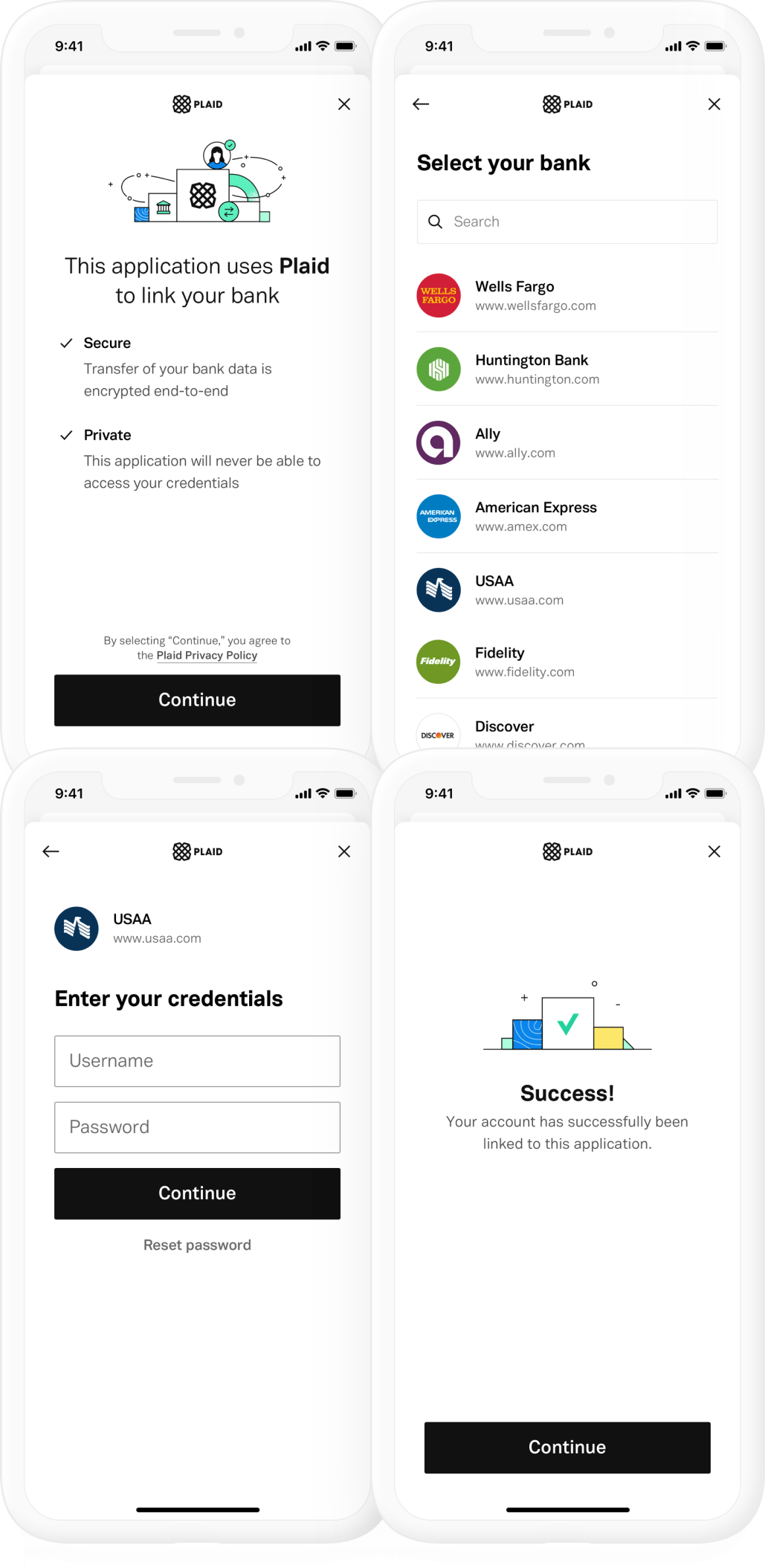

For folks who be considered to own a finances-out re-finance, you might complete the application toward FHA loan. Making an application for refinancing is similar to making an application for your first home loan. You are able to collect every documents one show your earnings, bills, and you may property, and you will probably read a credit assessment along with your lender. It’s adviseable to prepare to display the financial a recent home loan statement you to definitely proves you’ve made uniform costs on your own home getting the very last season.

Certain kinds of FHA refinancing none of them an assessment, however you will you would like an appraisal for a money-out refi. Your financial use the fresh appraised property value your house so you can decide how far bucks you can discover regarding package.

When your application might have been approved and your assessment has been done, your bank can intimate on your own the mortgage. You need to anticipate your own closing costs to help you add up to dos% to help you 5% of your own loan, and you may sometimes pay that it debts up-side otherwise include it with your mortgage balance.

An FHA bucks-aside re-finance will be a great way on precisely how to faucet in the residence’s collateral while also protecting less rate of interest on your financial. You will find usually advantages and disadvantages so you’re able to refinancing, even though, so you should consult an expert to choose whether or not otherwise perhaps not here is the right choice for you. Schedule an appointment which have a financial specialists knowing about you https://paydayloanalabama.com/whitesboro/ could make use of an FHA dollars-away re-finance. If you approach you re-finance very carefully, you should be happy with the outcome.