Cost Limits for instance the income limitations, your house one to borrowers are interested in must be lower than a great certain well worth.

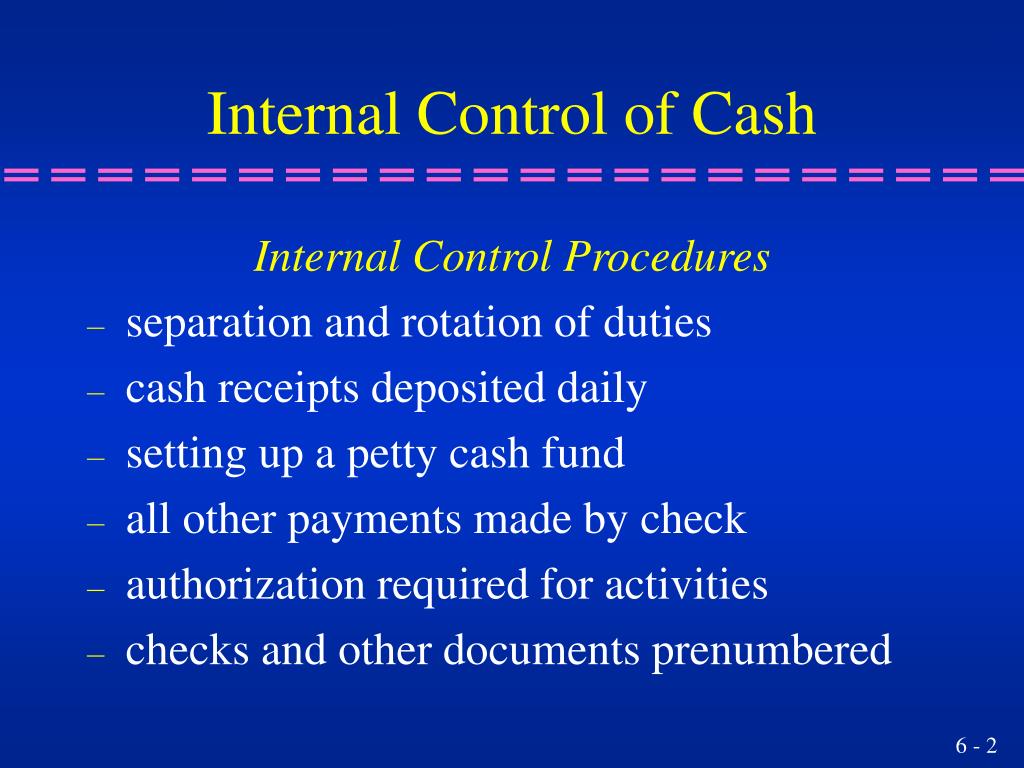

To gain access to the funds and get speed limitations on your county, take a look at this graph provided by IHDA:

While not mandatory, you phone loan online will find property counselors offered to address questions and you may wade more than pre-pick planning. For more information on this subject, take a look at the information about IDHA’s site here:

S

If you were unwilling regarding the to get a property on account of scholar loan financial obligation, the brand new S would-be exactly what you are looking for. The bank will pay 15% of one’s purchase price to the incentives of your own figuratively speaking to $40,000. Moreover it has a good $5,000 deferred mortgage which can be used to possess down payment advice or settlement costs. This might be a federal national mortgage association program that will only be utilized which have a thirty-season fixed interest.

To qualify, you’ll want at least $1,000 in education loan debt and get newest for the costs. Income and get speed constraints are used. All college loans should be reduced at the closure of the advice or even in consolidation with the borrower money.

Starting Doors Program

Part of the purpose of the opening Doors program will be to boost homeownership accessibly, offer possession, which help stabilize groups. It will offer up to $six,000 into the advice which is forgiven more 5 years.

Ensure that you twice-consult your bank and make sure they give you the application form you desire before you commit to some thing. For every single IHDA system is designed to assist individuals inside a specific circumstance and certainly will become a good option for any homeowner.

Just like any mortgage the 2 typical standards so you’re able to safer investment was earnings and you will credit rating. In terms of mortgages, there’s a lot a great deal more considered in case you will be good from the most other several you should not have many difficulty on process. Complete, it is around the financial institution you happen to be handling to agree otherwise refute the job and there is many reasons the reasons why you could get approved or rejected.

Whom Pays Settlement costs inside Illinois?

There’ll be settlement costs of the consumer and merchant out of a property. Closing costs will generally complete between step one-3% of your house’s worth. On vendor the expense feature moving this new possession of the house. Towards the buyer the newest settlement costs was associated with protecting your home loan. One common misconception is the fact that downpayment are aside regarding this new closure cost if you’re slightly best your advance payment could be listed on their own from the other closing can cost you. Before you reach brand new closing desk, you will see the entire costs indexed along with your down-payment, which means you know precisely simply how much to help you cord during the closure.

Quite simply, sure! You will get a closing revelation number all your valuable closing charges very early for the financial processes. When you see a thing that looks unusual otherwise excessive out of a payment speak about they with your financial there would-be an alternative choice. Lenders work with many third parties additionally the fees they charge can often be discussed otherwise an alternative 3rd party can be have fun with. Both lenders otherwise a property people might coverage your settlement costs whether they have an alternative system otherwise deal happening! Definitely comparison shop and get an informed contract to have your financial situation!

When you have any questions otherwise really wants to begin the latest homebuying techniques today reach out to Area Financing!

For every of them software, aggressive rates of interest are offered however, there are qualification criteria. You’ll find family income and purchase price limitations (advice lower than), but one another this new structure and you may current land meet the criteria. There is at least credit history off 640 needed.