Money Government

With a reputation getting managing the monetary needs from outstanding individuals, Citadel Financial support Economic Characteristics unique approach to wide range government centers into the goal and you can pertinent information, motivated by the brilliant and you may trusted relationship. Specialist in the navigating the complexities away from the current monetary world, i make sure that your wide range works in your favor.

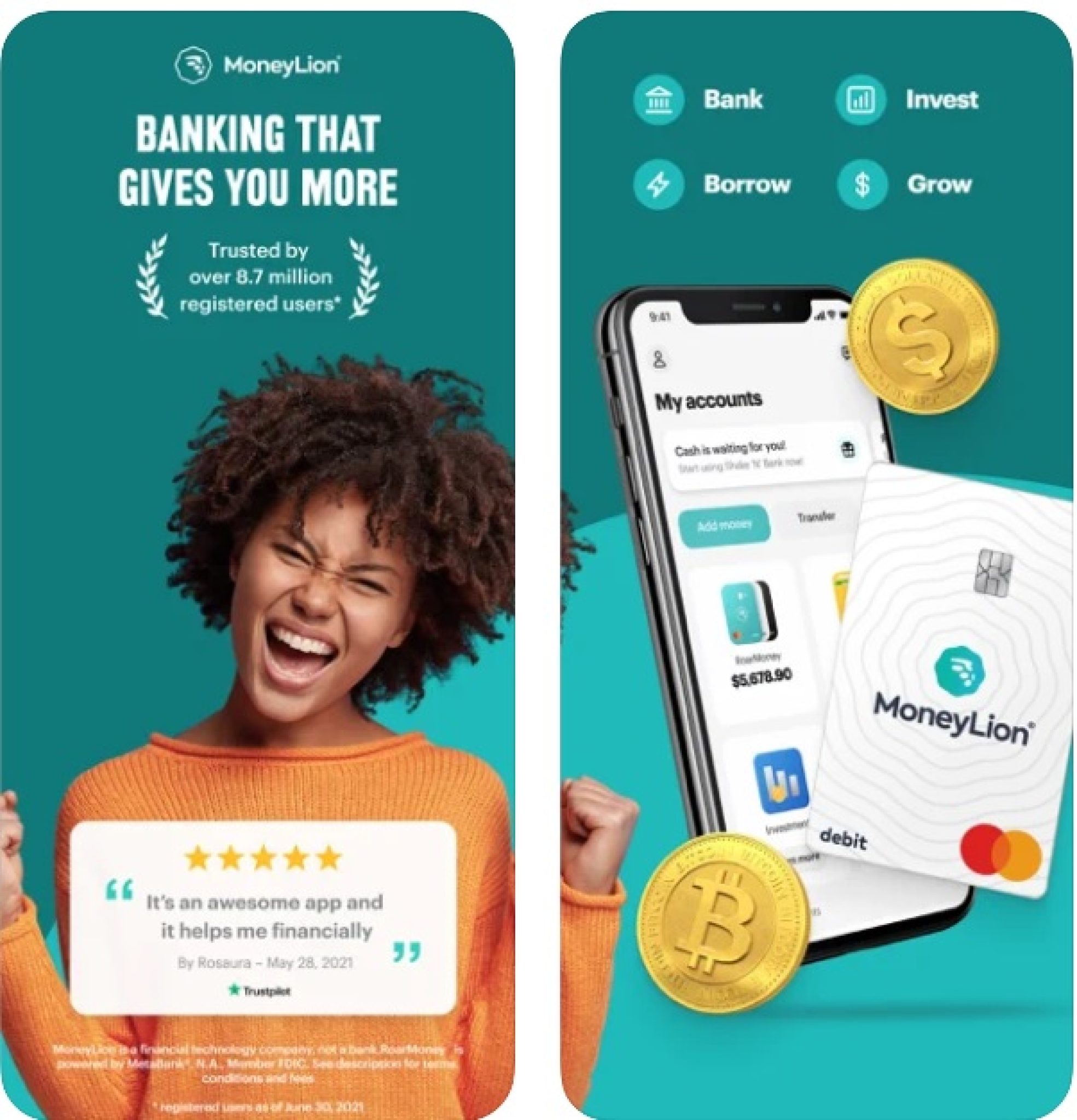

Sign up for our very own electronic attributes, at once

We take care of tall amounts of coverage to ensure all the customers account remain secure and safe and you will safe, you might monitor your bank account through Electronic/Cellular Banking Interaction things. I tune in, we know therefore keep in touch with one another. Therefore we worry about you and where you are heading.

Services To match You

Chequing and you may deals accounts, mortgages, money, playing cards, investment choices and. The services and products make it easier to take control of your currency, with in-branch and you may digital availability, it’s simpler.

I satisfaction ourselves inside our imaginative but really standard strategy, our very own ability to performs directly that have members in addition to their advisers into the seeking solutions, and also in our capacity to level all of our properties since the readers build. Our very own readers are social and personal organizations, and additionally institutional people, all seeking to availableness the global investment avenues to own effective financial support formations, doing work all over numerous groups, in addition to those people looked right here. Ler mais

Erika Rasure is actually globally-seen as the leading individual economics matter expert, specialist, and you will teacher. She actually is an economic specialist and you can transformational coach, having another type of need for permitting female learn how to purchase.

What exactly is an ending Declaration?

A closing declaration is a document you to definitely facts the main points off a financial deal. An effective homebuyer which cash the acquisition will receive an ending declaration regarding lender, due to the fact family supplier will get one on the a house representative whom addressed the fresh income.

Key Takeaways

- A mortgage closure report listing the will cost you and you can fees on the financing, as well as the complete number and you will fee agenda.

- A closing report or credit agreement is provided with any sort out-of loan, have a tendency to into software itself.

- An excellent seller’s Closure Disclosure is prepared from the funds broker and you can listing all the income and you will can cost you in addition to the web overall as paid back toward vendor.

- With many variety of loans, you can also discover a fact during the Credit Disclosure mode in place of an ending Revelation.

Knowing the Closing Statement

no credit check loans in North Dakota state

When resource property get, consumers can get observe that loan imagine inside three days out-of trying to get a mortgage. Prior to closing, the buyer get the last Closure Disclosure. While the vendor, you’re getting an equivalent Closure Revelation you to shows your information along together with your liberties and you can obligations due to the fact provider.

The borrowed funds Closure Report

Learning and you can acknowledging the final Closure Revelation is amongst the past methods one a borrower must take prior to signing towards dotted line and taking the bucks to own a mortgage or refinancing. Ler mais

MIPs, otherwise mortgage insurance fees are yearly payments towards HUD mortgages, paid back in the closing and you can a year. To possess HUD 232 financing, MIP try step 1% of the amount borrowed (due on closing) and you can 0.65% a year (escrowed month-to-month).

What is the function of MIP (Financial Premium)?

The reason for MIP (Financial Top) is to bring most coverage on the lender if there is standard for the loan. MIP try a yearly percentage on a good HUD mortgage, paid within closing, for every season of structure, and you can a year. To own HUD 223(f) finance, MIP try 25 basis issues to possess characteristics playing with an eco-friendly MIP Reduction, 65 basis products for market rates qualities, forty-five base issues for Part 8 otherwise the fresh currency LIHTC characteristics, and you will 70 basis products having Point 220 metropolitan revival strategies one aren’t Part 8 or LIHTC. Having HUD 232 loans, MIP is step one% of one’s amount borrowed (due at closing) and you may 0.65% a year (escrowed month-to-month).

MIP (Financial Premium) can cost you are different depending on the financing system. To the HUD 223(a)(7) financing system, MIP prices are 0.50% upfront and 0.50% annually to have markets speed features, 0.35% initial and 0.35% a-year to possess affordable properties, and you can 0.25% initial and you will 0.25% a-year having eco-friendly MIP characteristics. Ler mais