Regarding TATA Funding Unlisted Show

In the big expanse of your own Indian financial markets, particular labels reverberate that have a history of trust and you can precision. Tata Sons Limited, among the nation’s premier business conglomerates, keeps constantly become the leader in operating perfection in numerous sectors. A notable part not as much as their umbrella is actually Tata Financing.

Produced out from the esteemed origin away from Tata Sons Minimal, Tata Capital symbolizes the rules from trust and you may consumer-centricity the Tata Classification is known for. As a single-stop monetary selection spouse, Tata Money isn’t only an entity; it is a promise to the greater spectrum of merchandising, corporate, and institutional users.

This vow transcends for the some monetary streams, guaranteeing a comprehensive bouquet away from functions you to focus on the newest diverse monetary criteria of their clients.

At the heart off Tata Capital’s offerings try its of a lot certified subsidiaries, for each and every adeptly catering in order to a distinct segment portion, making certain the needs of all of the customers, whether it’s private or business, was meticulously handled.

Tata Funding Economic Functions Restricted: Performing less than so it part, Tata Financing also offers many economic characteristics. Out-of corporate funds and you will commercial financing so you can local rental and you may outlying loans, the firm has actually secured a standard spectrum of qualities. Ler mais

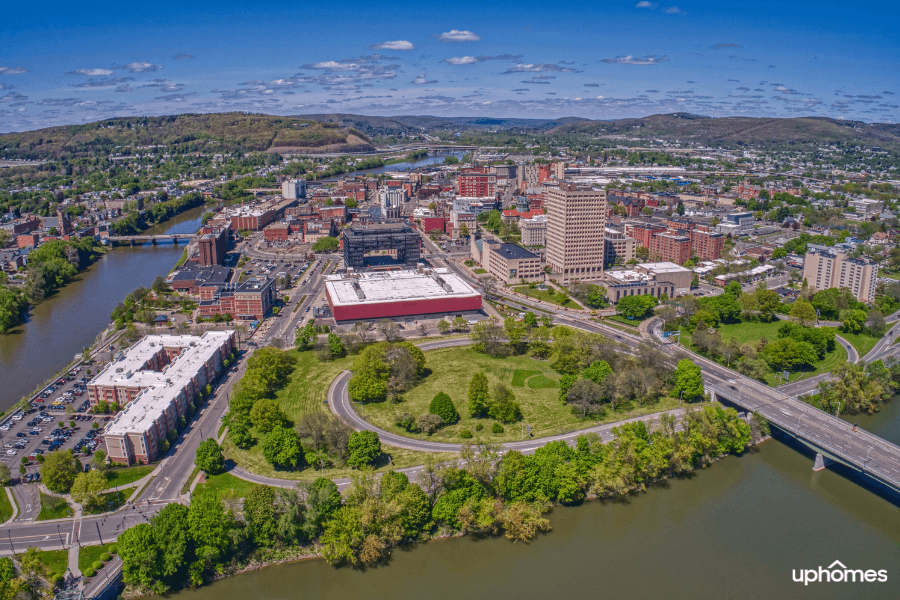

Overview of Idaho Mortgage loans

Home loan prices hover around the national mediocre during the Idaho. The fresh new Treasure County is larger than each one of Brand new England, however it is plus among the many least populous states regarding the nation. About three Idaho areas possess conforming loan constraints over the fundamental draw from $726,200.

Federal Mortgage Pricing

- Idaho home loan calculator

- Idaho assets taxes

- Idaho later years taxation

- Idaho income tax calculator

- Find out about financial pricing

- How much house would you pay for

- Determine month-to-month home loan repayments

- Infographic: Ideal urban centers to locate home financing

Idaho Mortgage loans Analysis

Idaho a home might have been a bit more pricey as compared to remaining portion of the country in recent years. The new average household worthy of on the condition is $369,3 hundred, given that national median try $281,400.

Extremely areas in the Idaho provides a conforming mortgage limit at basic $726,two hundred Although not, Blaine and you can Camas areas has actually a limit out-of $740,600, if you are Teton state provides a limit out-of $step 1,089,three hundred. This might be an expression of the high average home rates when it comes to those counties. FHA limitations within the Idaho mostly stick to the normal $472,030 restrict, having a loans in Waterbury small number of exclusions.

Idaho try an action away from believe county, definition when you take out home financing regarding Treasure State you’ll likely get a deed off trust unlike an enthusiastic actual mortgage. Lenders whom issue mortgage loans have to go to court so you can foreclose into house that the mortgage relates to. In case a confidence action is out there as an alternative, a lender can also be start a power from selling foreclosure from the hiring a third party so you’re able to auction our home it really wants to offer, missing the fresh new legal processes. Ler mais

BOSTON , /PRNewswire/ — Brand new Federal Mortgage Bank out-of Boston established their initial, unaudited third quarter results for 2024, revealing net gain of $sixty.4 mil on the quarter. The lending company needs in order to document their sydney to your Form ten-Q towards one-fourth finish , on the You.S. Securities and you may Change Fee the following month.

36%, new everyday mediocre of your own Secure At once Funding Speed to your third one-fourth away from 2024 as well as 3 hundred base points. New dividend, according to average stock the on the 3rd one-fourth from 2024, could be paid down to the . Of course, returns remain at the newest discretion of the panel.

“FHLBank Boston’s solid monetary results will continue to assistance a standard assortment off exchangeability and you can capital selection for the people, and present programs and you may initiatives you to boost construction affordability and raise community creativity through the The new The united kingdomt,” told you Chairman and you will Ceo Timothy J. Ler mais

Pros and you can energetic military professionals gain access to a few of the most readily useful mortgage brokers readily available. The most popular matter asked by veterans and you may energetic-responsibility armed forces players was, Which are the benefits associated with good Va home loan?

The answer would be complex. The bonus is actually these types of money render military players accessibility well low interest rates and more versatile conditions comparatively. Yet not, there are also a number of misunderstandings about Virtual assistant funds that should feel cleared up. Here is a go through the best five.

5 Misconceptions Regarding the Securing Va Financing

Accessing a Va mortgage makes the property procedure convenient and economically safer to possess members of the latest armed forces. But many veterans do not understand the method, or they have completely wrong details about the latest Virtual assistant home loan system. Military Homespot can provide you to definitely clearness, let’s review.

#1: You should be an experienced so you’re able to Qualify for a good Virtual assistant Financing

The truth is anyone who caters to or has actually supported throughout the U.S. Army are eligible to own a good Virtual assistant loan. This can include productive-duty team, reservists, Federal Protect professionals, and you can veterans. Actually spouses of deceased provider participants is generally eligible for a beneficial Virtual assistant loan should they fulfill other eligibility standards.

#2: Va Funds Want an advance payment

An alternate well-known myth from the Virtual assistant loans is that you must set out cash in order to qualify for you to. That isn’t correct; you can get a great 100% capital loan without money requisite just like the a downpayment. Ler mais

Brand new housing market was experiencing revived focus as 30-year financial pricing more sluggish drop responding in order to cues that the Given possess accomplished its rate walking cycle. Considering signing up for all of them but you desire a beneficial primer towards mortgage loans? Keep reading understand the basics, together with exactly what goes installment loan application Mississippi in a monthly payment and exactly how much it is possible to need to rescue.

It is recommended that you create a summary of at least around three lenders to speak with so you can examine the now offers. (UBS)

Pricing having 29-seasons mortgage loans has actually diminished from the nearly a whole commission point just like the the fresh new 20-year a lot of eight% within the November, says This new Wall structure Roadway Journal. Ler mais