Antique loan off costs start just step three% for first-day homebuyers. Or, you could potentially pay 5%-10% out of pocket to lessen their rate of interest and you will costs.

Placing off 20% or maybe more becomes your away from purchasing PMI – however, that does not mean it’s the proper choice for individuals. Of many consumers come across they are better off with an inferior, less costly down-payment.

- Minimum downpayment

- Downpayment possibilities

- Do I wanted 20% down?

- Down payment impression

- How much cash to get down

All old-fashioned mortgage loans wanted a down-payment. But the matter need can differ generally. Homebuyers can make a traditional downpayment anywhere between 3% and 20% (or maybe more) according to the financial, the loan program, together with speed and located area of the household.

Understand that once you establish lower than 20% into a normal loan, you have to shell out private mortgage insurance (PMI). So it visibility will act as a protect to lenders in case borrowers default to their loans.

PMI can cost you just as much as 0.5% to 1.5% of amount borrowed a year. Although not, it will always go off over the years after you’ve accumulated sufficient guarantee yourself.

Homebuyers can select from an array of old-fashioned loan down money. The most used number is actually step 3% down, 5% down, 10% off, or even the complete 20% down. Here is what your own financial alternatives look like at each deposit tier.

Old-fashioned fund having step three% down

Traditional financing software that allow 3% off are typically set aside getting basic-big date buyers and/otherwise down-money individuals. On the other hand, you usually need to buy one-members of the family top home.

Discover four fundamental software offering step three% down costs, such as the conventional antique 97% LTV mortgage, Freddie Mac’s Family You’ll loan, Freddie Mac’s HomeOne mortgage, and you can Fannie Mae’s Domestic In a position financing, states Deb Gontko Klein, part movie director for Precision during the Financing – PRMI Chandler. Ler mais

The transaction provides a security worth of everything USD5.4 billion and you can an enterprise value of just as much as USD8.6 mil, like the presumption out of obligations.

Pursuing the close of one’s deal, Deb McDermott will end up Ceo and you can Mr. Kim often act as President out of a different sort of Panel. Ms. McDermott currently functions as President regarding Simple Mass media and has now a great deal more than simply two decades of experience best transmit teams, as well as prior to now serving because the COO from News General so that as Chief executive officer and you can Chairman of Younger Sending out.

The order thought means a premium around 39% to TEGNA’s unaffected closing share rate on , the very last full change day ahead of mass media conjecture in the a potential revenue off TEGNA, and a made of around 11% to TEGNA’s all-time highest closure price since the . Ler mais

Due to the fact Va Mortgage try guaranteed because of the Service regarding Pros Points, there are many Minimum Assets Conditions (MPRs) your Virtual assistant has applied. These conditions are made to ensure that the house is an excellent safe household and you can a sound money to your veteran or solution member. Characteristics need see all of these conditions prior to being approved having a hope of one’s loan from the Virtual assistant.

All features that are purchased having fun with a Virtual assistant Mortgage need certainly to have been appraised by the a great Virtual assistant-tasked and you can authoritative appraiser. These appraisers cash advance loans installment New Mexico bad credi are required to mention one conveniently obvious fixes one to the house or property need and should suggest fixes for conditions deemed so you’re able to fail MPRs. Eventually, the brand new appraisers tend to imagine the worth of the house or property. One to really worth can be used to decide whether or not the quantity of the latest proposed loan is sufficient.

It is vital to note that an excellent Virtual assistant-assigned appraiser isnt property inspector and should not become thought an option to one.

Secure, Voice, and you may Hygienic

A new MPR established of the Virtual assistant is that the property have to be safe, structurally sound, and you will hygienic. The new appraiser should determine perhaps the family match these types of three requirements and make certain your possessions has no protection risks which is a no-brainer for the home buyer, the lender, as well as the Va. Ler mais

- Choose the best domestic: Pick a real estate agent to help you get the best home. Before you go, you could setup an offer-and in case approved, get in touch with the www.paydayloancolorado.net/allenspark American Pacific Financial advisor so you rating a jump start to the next methods.

- Complete underwriting checks: You can proceed through all the typical closure strategies for your financing sorts of. For almost all money, this can include delivering an entire appraisal, to purchase a residents insurance plan (and flood insurance coverage, in the event the applicable), examining to ensure the home has actually an obvious title, an such like.

- Sign one last files: Get the pencil in a position. You will have to spend time going right on through the files to suit your brand new financial, as well as almost every other records required by your state. Ler mais

The latest kiwi dream about shifting in the assets hierarchy stays really within reach for those individuals with managed to carry themselves right up on the ladder’s tough very first rung.

is the reason Home loan Value Report is famous having tracking how reasonable (or perhaps not) the newest dream about home ownership is actually for first home buyers throughout the country.

together with songs how well place basic homebuyers which purchased the earliest domestic ten years in the past should be to grab the next step and buy a far more pricey home now.

The results strongly recommend this new housing market might have been most type so you can men and women first homebuyers, despite the problems which have plagued industry throughout the second half of your history several years.

People first homebuyers must have gathered a significant away from equity in their very first household, sufficient to possess a hefty deposit on their 2nd household. Additionally the mortgage repayments thereon should use below a-quarter of its newest once-taxation pay, given he could be making at the least mediocre earnings.

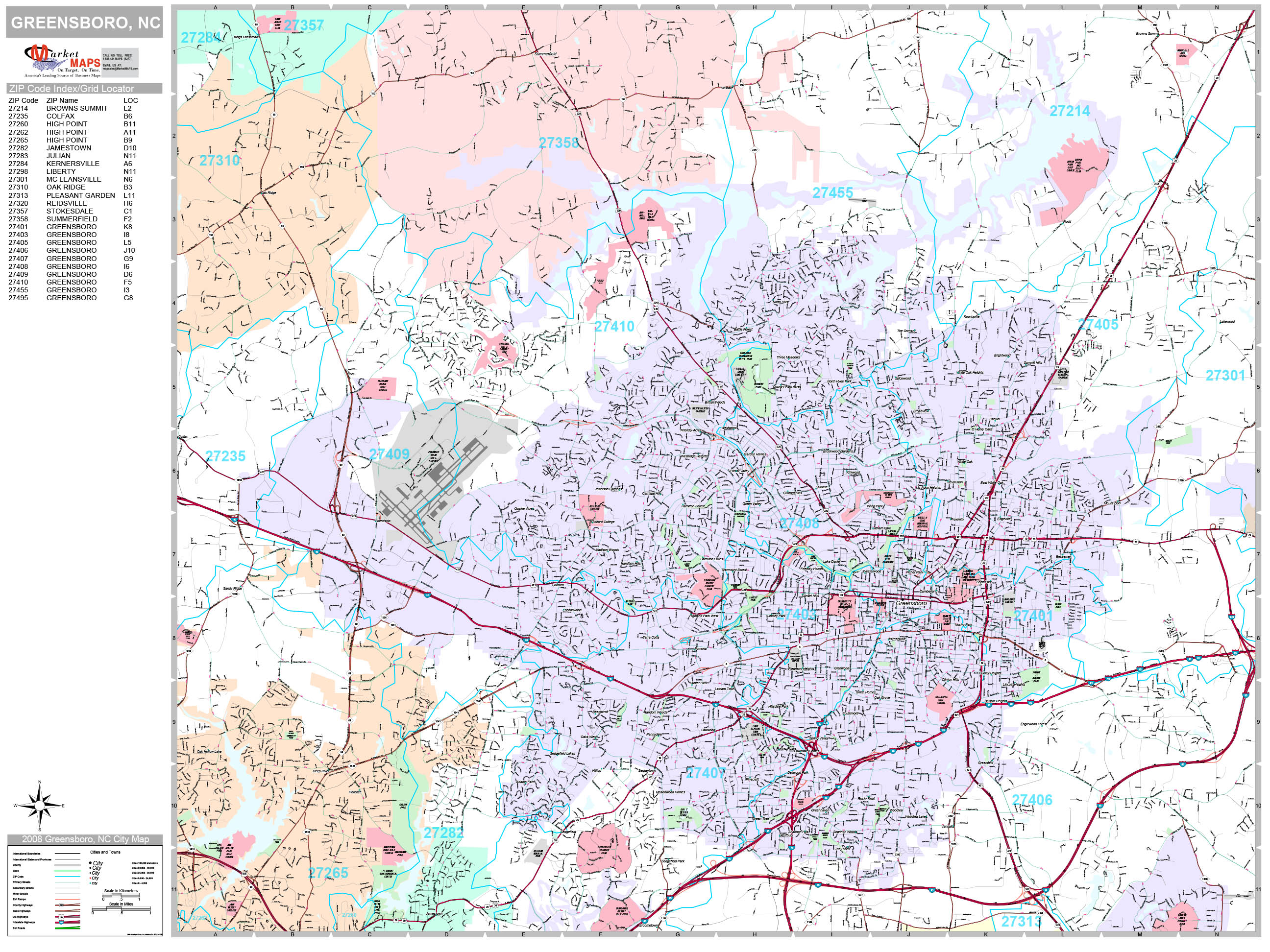

The 2 sets of dining tables lower than inform you the main local and area cost measures for first homebuyers from ten years in the past seeking to jump up in their 2nd family, based whether or not they originally bought you to definitely basic home with good 10% or 20% deposit

For example venturing out of this first family and you may ahead and you will up in their second home is going to be well within their started to.

At the time, the average of both year repaired costs recharged by the big financial institutions are six.13%, of course, if our home was actually ordered with an excellent 10% deposit, the brand new weekly home loan repayments would California installment loans have been $399 weekly.

Thus a decade before, home ownership try a pretty reasonable proposition, even for somebody typically earnings, even if one thing were starting to score strict getting very first home consumers thinking of buying for the Auckland which have the lowest put. Ler mais

Interested in a good amount of answers in one set? Here are some my Decisive Guide to SBA Default and provide Into the Sacrifice.

Back when you first got your own SBA loan, life try since exciting just like the could be, while the selection appeared unlimited. Basically, that which you are finding out about. Maybe the loan try financing the latest expansion of one’s currently winning business. Maybe your loan is to invest in you a current effective company. In either case, your envision you’re heading down the trail in order to enterprising profits. Sure sir, in a few brief decades (or perhaps a little stretched) you’ll sooner or later become standing on a beach someplace. Perhaps consuming a glass or two with a little umbrella with it.

Shortly after numerous years of finance companies financing money to people that simply don’t provides the capability to pay it back, the fresh new you-know-what hits the new enthusiast during the . The brand new home-based financial field melts away off and you can banks initiate collapsing leftover and you can proper, the market plummets, plus the savings quickly uses fit. Ler mais

So, make sure to browse the terms and conditions and you can know in the event the here is any obstacles so you can an early on leave in the mortgage

Obviously, all of that just provides a backdrop up against that you’ll understand how software can also be can be found. That’s the reason you’re inquiring the most obvious matter,

Money no advance payment was high-risk for the reason that feel because the, no equity at home, it’s likely you’ll end up being upside-down if anything crappy happens during the very first several years of the loan, especially if the housing marketplace drops or remains flat throughout that months

Efficiently, the solution to this is the same whether or not or not the loan is in an alternative program or perhaps not: Make sure to know their economic visualize by themselves off just what the bank informs you. Be sure to know what you really can afford, what chance you are happy to imagine, and you will exacltly what the options are if you want to changes https://cashadvanceamerica.net/installment-loans-ar/ things down the road (i.elizabeth. quickly promote our home).

The past section is essential. Don’t just make up your mind based on if you can pay for a payment. Definitely understand the “life” of loan, and you’ve got a valid hop out approach if the lives sets your a curve-basketball. Disregarding so it a portion of the decision is really what constantly becomes people on the difficulties. Somebody remove a loan that they may afford at this time but in couple of years it lose work, rating separated, or their mate dies. Ler mais