However, you are only allowed to claim home office expenses if you use the space exclusively for your eBay activities. Otherwise, you may be eligible for a business-use percentage deduction on your office supplies and furniture. EBay also collects VAT on digital goods and services provided to private buyers resident in Belarus. However, you should consult a tax advisor or contact the Department of Revenue for your state for further details as policies are different for each state. Tip

Even if you live in a state that does not impose a sales tax, you may still see tax calculated on your order if it is shipped to a state that does impose a tax.

- Moreover, sellers of these stores only consider these sales as a means to declutter their homes, earn some extra money, and just open them once or occasionally.

- However, if your buyer lives in Miami you’d charge them 7% in sales tax.

- If you’re an eBay seller — even an occasional seller — you’ll need to understand what types of taxes apply to your eBay business and how to pay them.

- You can find more information about applying for a TIN from the IRS.

ROCKFORD, Ill. (WTVO) — The Internal Revenue Service wants their share of your eBay profits. As of 2023, if you sell over $600 worth of products in 2023, you will need to report it to the IRS on a Form 1099-K, which eBay will send you. Sellers who qualify for a 1099-K Form will typically receive the documentation by January 31st in the year following the tax year. In addition to receiving commissions generated through affiliate marketing, we are able to fund our independent research and reviews at no extra cost to our readers. Tip

When you upload your documentation, make sure the image is clear and all information is clearly visible — otherwise we may not be able to verify your details.

Why am I paying sales tax on used items on eBay? ›

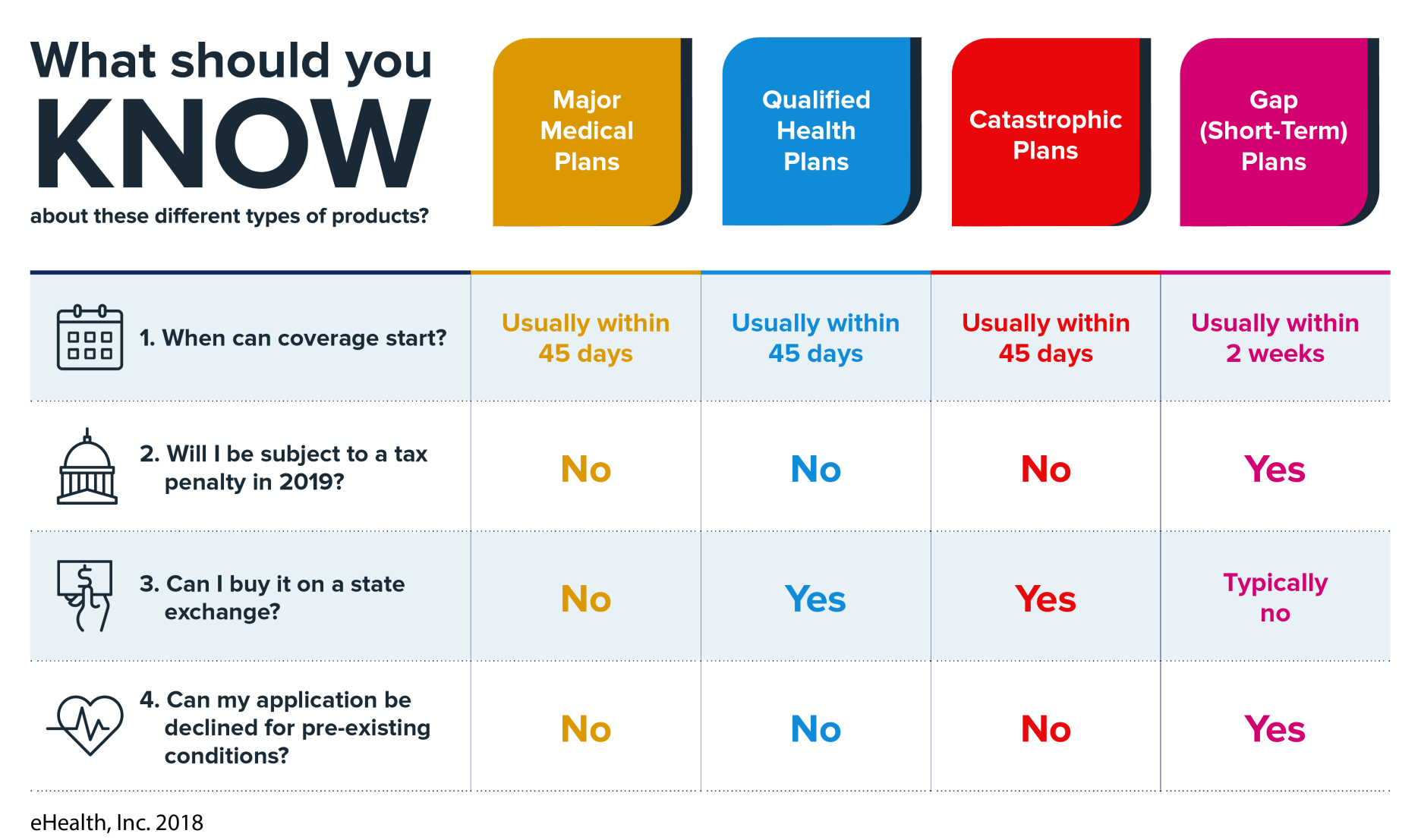

It is important to note that each state views the sales tax of online goods differently. Some apply sales tax at the point of origin and some apply sales tax where the buyer is located. In addition, recent legislation in 2018 established that you do not need to have a physical presence in a state to owe sales tax. This is why it is important to do your research on eBay sales tax early on, and set your listings up accordingly.

In that case, you might have to begin collecting sales tax on your own. Every US taxpayer has to pay income taxes on their take-home earnings. For most W2 employees, the process is automatic because filing ebay sales tax their employee deducts the taxes directly from their paycheck. However, eBay doesn’t deduct money for any federal tax obligations, so it’s up to you to pay the applicable taxes on your earnings.

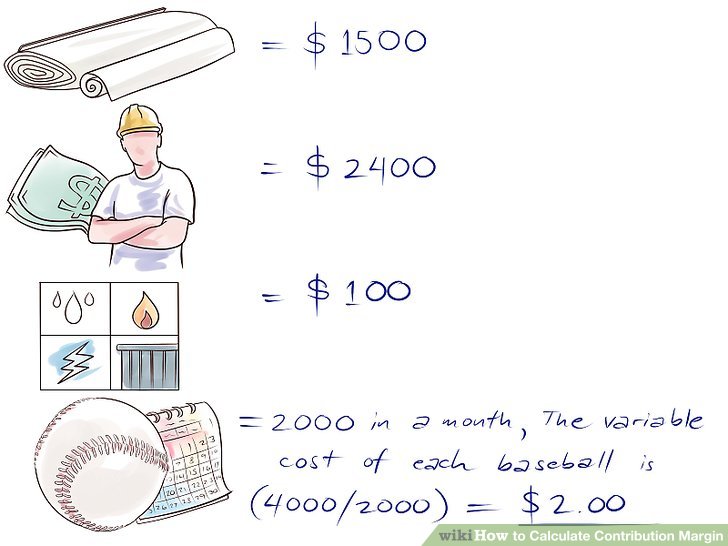

That makes Schedule C your best friend as a seller — even if it can be a little tricky to fill out. The tax rates, though, are twice as high for self-employed people like eBay sellers. Whether you’re drop-shipping, wholesaling, doing retail arbitrage, or selling your own products part-time, you’ll be nursing all the tax-related headaches that come with an online business.

For tax years beginning with 2023, if you have third-party payment transactions totaling more than $600 then you should receive a 1099-K form reporting this income to the IRS. For 2022, the IRS requires eBay and other online marketplaces to report total sales exceeding $20,000 and 200 transactions on Form 1099-K. Use the Form 1099-K that eBay sends to you when determining whether you have taxable income from the sale of goods. EBay will only collect and remit sales tax on your behalf when it is required of them by law in the applicable state. If you’re running into a situation where you can’t decide which sales tax rate to charge, TaxJar has your back! Our eBay integration will streamline your sales tax compliance and make charging and collecting sales tax from your eBay simple.

Which states require eBay sales tax?

Since you cannot use hobby expenses to reduce your hobby income, you won’t be able to use a loss from hobby sales to reduce other income. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail. Let’s explore how taxes for selling on eBay internationally differ from domestically. It’s not the most ideal system for sellers, but it’s what they are stuck with for now. You can keep the 6% rate and undercharge your Miami customers, or raise it to 7% statewide and overcharge all your buyers in Florida.

Do I have to collect tax on my eBay sales?

However, that doesn’t mean you don’t have to pay taxes on the earnings. You must declare the income on your year-end tax return and pay the appropriate income and self-employment taxes on the funds in question. It’s one of the oldest eCommerce marketplaces, and most consumers are very familiar with the platform. However, as your eBay sales grow, you have to start taking planning for eCommerce sales tax. To show the IRS you did not make a profit on your sales of used goods, it’s always advisable to keep receipts of the original purchase. If you don’t have the receipt showing how much you spent on your inventory, you can use the fair market value to price your items.

Accountants who earn this certification have passed a comprehensive three-part exam on individual and business tax returns. To maintain EA status, they must stay up to date in the field by completing 72 hours of continuing education every three years. The 24% tax taken from future payments to ensure the IRS receives the tax due is known as backup withholding.

The documentation required for tax exemption can vary from jurisdiction to jurisdiction. Use the dropdown menus below to see documentation required for your jurisdiction. A content writer in the SaaS, FinTech, and eCommerce spaces, Jake Pool has written hundreds of articles and reviews for dozens of corporate blogs and online publications. With four years under his wing, readers can expect many more informative articles in the future. You can also use third-party tools such as TaxJar to create easy-to-use sales reports.

Why eBay may apply backup withholding

The Tax Information Center offers expert articles, blogs, tips, and insights that may be relevant to your unique situation. Following are frequently asked questions about the new requirements and information you need to know to help ensure that you’re compliant when you file your taxes. For the most part, eBay is now calculating, collecting, and remitting sales tax for purchases made in most states. However, if you need to remit sales tax for states that are not included, or for other selling platforms, the easiest and most secure way to pay your tax bill is online.

As of 1 July 2021, eBay is required to collect VAT on certain orders delivered to EU addresses. Please check this page regularly as we are continuously updating the following table as states adopt new laws and regulations https://turbo-tax.org/ regarding sales tax collection. If your shipping address is in one of the marketplace responsibility states within the US, applicable sales tax will be collected by eBay and included in the order total at checkout.

Keep an eye on your mail and eBay seller’s center to ensure you don’t miss it. EBay recently stopped using PayPal as their primary payment processor, and the company now handles most transactions internally. As a result of this change, the IRS now classifies eBay as a payment processor for your tax purposes. If you’ve made more than $400 in net profit from your eBay sales, you’ll also need to fill out Schedule SE to figure out how much you owe in self-employment taxes. Your hobby income from eBay will need to be reported on Form 1040, using Schedule A for itemized deductions. Since your activities are considered a hobby, you won’t be able to claim losses.

Online platforms like eBay are required to make your 1099-K available by January 31st. If you sell on eBay, your tax situation will involve a lot of forms — forms you get and forms you fill out on your own. Think of these as 21st-century versions of the garage sale or yard sale. They let people offload old clothes and appliances to a group bigger than their neighborhood.

Since Florida does not have a marketplace facilitator law, you are still required to collect sales tax from that buyer. On the face of it, these changes should help simplify sales tax for eBay sellers. But eBay does not collect sales tax for every state where it could be due, and your buyers still care about sales tax – and how much you appear to be charging them – even if you don’t. We are here to answer tell you exactly how to deal with new regulations and ebay sales tax processing systems.

This can be beneficial since you will have two separate firms checking the work. The disadvantage, however, is that you might have to project manage and help coordinate between them. If you have a Certified Public Accountant (CPA), we can handle your monthly bookkeeping and then send your financials and tax prep info to your CPA at year-end.

If you’ve decided to engage in an outsourced accounting services relationship, consider these tips to maximize your investment. Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month. Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses. Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged. Bookkeeper360 offers a pay-as-you-go plan that costs $125 per hour of on-demand bookkeeping support. It’s an ideal plan for businesses that need minimal monthly support, though if you want more than two hours of help a month, you’ll save more money simply going with a service like inDinero or Bench.co.

And the brand brings significant value to the table in the form of risk mitigation and contractor management. Paychex is yet another top name in payroll software, support and outsourcing. They have solutions for solopreneurs all the way up to enterprise-level organizations. And they cover needs ranging from hiring and onboarding to benefits to payroll and beyond. This list will guide you through six of the top providers in payroll outsourcing and software tools, and we’ll offer advice on how to research and sift through your options to find the right one for you. However, if your company boasts a well-established finance leadership and infrastructure, outsourcing may not be essential.

Outsourced controllers also bring a tried and tested approach to helping manage your business’s finances. That know-how gives them the ability to build your business a financial infrastructure that’s resilient to all kinds of challenges. Without strong bookkeeping, it’s impossible for business owners to understand the financial position of their business, forecast budgets, or understand their cash position. When a business outsources its accounting, it essentially transfers responsibility for some or all of its accounting tasks to a third-party accounting firm. Before you can start thinking about how outsourced accounting might benefit your business, it’s crucial to understand exactly what outsourced accounting is (and isn’t). By applying an output-focused approach, we can help companies define and establish what resources are needed to produce long-term, value-driven outcomes—not just filling staffing needs.

- The latter’s flexibility means they can quickly and resolutely resolve any past accounting issues and provide the exact services your business needs.

- Therefore, it’s crucial to select reputable outsourcing partners who prioritize robust security measures.

- Smaller businesses might get by with a basic Quickbooks set-up, but once you start growing, building a more sophisticated financial infrastructure is vital.

- There are plenty of features, functionalities and benefits that a given business might need from their payroll support vendor.

- With the QXAS Tracker App, you can monitor the progress of your accounting tasks in real-time.

A local bookkeeper is an individual or firm based in your geographic area that handles accounting services. If the business is growing too fast for signs like these, you can choose between hiring an in-house accountant or outsourcing accounting. The latter’s flexibility means they can quickly and resolutely resolve any past accounting issues and provide the exact services your business needs. It’s likely that an outsourced CFO has experienced these challenges before, making them well-qualified to advise your business on its strategic direction. Challenges in working with an outsourced controller typically occur when communication is infrequent.

In conclusion, as a small-business owner, mastering efficiency in tax and accounting is a continuous journey. By implementing these strategies, you can not only help streamline your financial processes but also potentially position your business for sustained growth and success. Opt for a payroll provider that embraces technology, offering features like automated payroll processing, PTO tracking and real-time reporting. Any additional cost will be worth it’s weight in gold vs. archaic payroll systems.

Accounting software

By embracing accounting outsourcing for CPA firms, these organizations can position themselves for greater efficiency and success in an ever-evolving industry. Outsourcing routine accounting functions liberates CPA firms to allocate their in-house resources and skills to more value-added services. Instead of being bogged down by time-consuming tasks, such as data entry or reconciliation, CPA professionals can dedicate their expertise to strategic advisory, financial planning, and client consultation. With the QXAS Tracker App, you can monitor the progress of your accounting tasks in real-time. Outsourcing your bookkeeping to an accounting firm ensures that your business’s financial data is organized according to best practices. Outsourced accounting firms tend to use cloud-based bookkeeping technologies that provide business owners with a real-time overview of their business’s financial position.

When considering outsourced accounting services, the cost factor is as diverse as the services offered. It’s not a one-size-fits-all scenario; instead, the price depends on the specific needs of your firm. But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. There are a number of benefits that businesses can realize from partnering with an outsourced accounting services firm. At a high level, working with an outsourced accounting services firm allows businesses to embrace high-quality accounting processes at a fraction of the cost of managing these processes with an internal team.

Previous PostERC Audits: What Companies Need to Know

To learn more about LBMC’s outsourced accounting services, contact an advisor today. Managing financial accounts, from bookkeeping to financial reporting, to managing invoices remains a pivotal aspect of any business strategy. Yet, this task https://www.online-accounting.net/ can be time-consuming and challenging, especially for SMBs lacking dedicated financial professionals. Bookkeeper.com is an all-around solid pick for small to midsize businesses that might want additional payroll and tax help down the road.

In this comprehensive guide, we’re exploring every element of outsourced accounting. We’ll share the types of tasks that can be outsourced and highlight the key issues business owners need to consider when assessing outsourcing accounting providers. Ongoing support is also offered for changing compliance and regulatory standards to ensure your business is informed and compliant, minimizing the risk of financial discrepancies.

Business activities like running payroll are, obviously, a bit more involved and sensitive than, say, having someone run your personal mail to the post office. That said, at a fundamental level, outsourcing payroll or leveraging HR software solutions are in many ways the same as hiring someone to do your yardwork. Additionally, it’s crucial to consider the learning curve involved when integrating an outsourcing company into your business.

Inefficient Finance & Accounting

With access to real-time financial data from virtually anywhere, these technologies make collaboration easier and more efficient. It enables them to streamline operations, tap into specialized expertise, and refocus on their core strengths. However, the decision to embrace accounting outsourcing solutions should be a https://www.quick-bookkeeping.net/ well-informed one, weighing the advantages against potential challenges. Absolutely, reputable firms offering to outsource your accounting services typically have a portfolio of client references. These references are from various CPAs and accounting firms that have successfully outsourced their accounting functions.

Outsourcing your bookkeeping tasks can make a significant difference in the day-to-day operations of your business. The staff who previously managed these responsibilities will be free to work on new projects that help to grow the business, resulting in improved morale and productivity. If your firm doesn’t have a bookkeeper on staff, it’s likely they take up a significant portion of your time.

Unlike the accounting department, the treasury department consists of people that have actual access to the bank accounts and cash—don’t confuse the two! To avoid not just fraud or embezzlement, but also financial mistakes, you should rely on key individuals in your business for https://www.bookkeeping-reviews.com/ treasury access rather than outsourced accountants. They spend hours doing tutorials, chatting with support representatives, or double-checking their numbers. And every hour spent learning or managing accounting software is an hour not spent on generating revenue directly.

Outsourced accounting, alternatively called accounting process outsourcing, involves hiring a third-party firm to handle some or all of your company’s accounting functions. This includes tasks like bookkeeping, reconciliations, assistance with accounts receivable and accounts payable, financial reporting, payroll processing, and more. Outsourced finance and accounting have become increasingly popular among businesses of all sizes due to its numerous benefits. Reputable outsourced accounting firms prioritize data security and the protection of sensitive financial information.

The majority of companies that work with an outsourced accounting firm do so on an ongoing basis. At first, there may be a lot of work in building the financial infrastructure and accounting services. But after this initial set-up period, the relationship typically reverts to a stable monthly business cycle. These outsourced accountants undertake diverse accounting tasks, ranging from bookkeeping, payroll, and financial reporting to tax management, accounts payable, accounts receivable, debt follow-ups, and more. Looking for a scalable outsourced bookkeeping service with flexible payment options?

There is still a balance of $250 (400 – 150) in the Supplies account. The balances in the Supplies and Supplies Expense accounts show as follows. Insurance is typically purchased by prepaying for an annual or semi-annual policy. Or, rent on a building may be paid ahead of its intended use (e.g., most landlords require monthly rent to be paid at the beginning of each month).

The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. The mechanics of accounting for prepaid expenses and unearned revenues can be carried out in several ways. At left below is a “balance sheet approach” for Prepaid Insurance. The expenditure was initially recorded into a prepaid account on the balance sheet.

- Two main types of deferrals are prepaid expenses andunearned revenues.

- An income statement shows the organization’s financial performance for a given period of time.

- If a company uses a calendar year, it is reporting financial data from January 1 to December 31 of a specific year.

During theyear, it collected retainer fees totaling $48,000 from clients.Retainer fees are money lawyers collect in advance of starting workon a case. When the company collects this money https://www.wave-accounting.net/ from its clients,it will debit cash and credit unearned fees. Even though not all ofthe $48,000 was probably collected on the same day, we record it asif it was for simplicity’s sake.

Create a free account to unlock this Template

If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made. Printing Plus has $100 of dividends with a debit balance on the adjusted trial balance.

Atthe end of a period, the company will review the account to see ifany of the unearned revenue has been earned. If so, this amountwill be recorded as revenue in the current period. He does the accountinghimself and uses an accrual basis for accounting. At the end of hisfirst month, he remote bookkeeping services reviews his records and realizes there are a fewinaccuracies on this unadjusted trial balance. If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, meaning the company did not make or lose any money.

Interest Receivable increases (debit) for $1,250 becauseinterest has not yet been paid. Interest Revenue increases (credit)for $1,250 because interest was earned in the three-month periodbut had been previously unrecorded. The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff. Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year.

Closing Entries

As such, the beginning- of-period retained earnings amount remains in the ledger until the closing process “updates” the Retained Earnings account for the impact of the period’s operations. Using the table provided, for each entry write down the income statement account and balance sheet account used in the adjusting entry in the appropriate column. On January 9, the company received $4,000 from a customer for printing services to be performed. The company recorded this as a liability because it received payment without providing the service. Assume that as of January 31 some of the printing services have been provided. Since a portion of the service was provided, a change to unearned revenue should occur.

5 Prepare Financial Statements Using the Adjusted Trial Balance

Interest Revenue increases (credit) for $1,250 because interest was earned in the three-month period but had been previously unrecorded. Long-lived assets like buildings and equipment will provide productive benefits to a number of periods. However, one simple approach is called the straight-line method, where an equal amount of asset cost is assigned to each year of service life.

Deferrals are prepaid expense and revenue accounts that have delayed recognition until they have been used or earned. This recognition may not occur until the end of a period or future periods. When deferred expenses and revenues have yet to be recognized, their information is stored on the balance sheet. As soon as the expense is incurred and the revenue is earned, the information is transferred from the balance sheet to the income statement. Two main types of deferrals are prepaid expenses and unearned revenues.

2: Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries

This takes information from original sources or activities and translates that information into usable financial data. An original source is a traceable record of information that contributes to the creation of a business transaction. Activities would include paying an employee, selling products, providing a service, collecting cash, borrowing money, and issuing stock to company owners. Once the original source has been identified, the company will analyze the information to see how it influences financial records.

For example, a company performs landscaping services in the amount of $1,500. At the period end, the company would record the following adjusting entry. Depreciation Expense increases (debit) and Accumulated Depreciation, Equipment, increases (credit).

Following our year-end example of Paul’s Guitar Shop, Inc., we can see that his unadjusted trial balance needs to be adjusted for the following events. Returning to Supreme Cleaners, Mark identified the accounts needed to represent the $200 sale and recorded them in his journal. He will then take the account information and move it to his general ledger. All of the accounts he used during the period will be shown on the general ledger, not only those accounts impacted by the $200 sale. One fundamental concept to consider related to the accounting cycle—and to accrual accounting in particular—is the idea of the accounting period.

Atthe period end, the company would record the following adjustingentry. Interest can be earned from bank account holdings, notesreceivable, and some accounts receivables (depending on thecontract). Interest had been accumulating during the period andneeds to be adjusted to reflect interest earned at the end of theperiod. Note that this interest has not been paid at the end of theperiod, only earned.

I was impressed with how you could do batch invoicing, something QuickBooks Online doesn’t offer. Businesses that have purchased one-time licenses of the locally-installed QuickBooks Desktop versions that have been sunset can still use the software’s accounting features. However, these versions don’t receive security updates, live support, or access to cloud-based services such as live bank feeds, QuickBooks Desktop Payments, or QuickBooks Desktop Payroll.

QuickBooks Desktop, on the other hand, is installed locally, meaning you download and install the software on your computer or multiple computers in your office, for example. Once installed, your accounting data will only be accessible on one of these devices, making it difficult to work on the go. But local installation means more control over your data, who has access, and overall general security of your business information. While the two iterations are different in some aspects, they’re essentially the same product, and the differences between them aren’t as glaring as they are with other accounting software solutions. The two iterations of QuickBooks’ accounting software shine in different areas. Whereas one is completely online and cloud-based, the other operates locally on your computer.

QuickBooks Online vs. Desktop

QuickBooks Payroll allows you to pay your employees by checks or direct deposits, e-file and e-pay taxes, print and e-file W-2 Forms at year-end, and more. Head to our detailed QuickBooks Payroll review to see if it fits the bill. Probably not, unless your business absolutely needs advanced inventory management features, barcode scanning, or assembly builds. Not only is it the newer tool, but it also seems to be the focus in terms of update frequency, development, and marketing. QuickBooks Online is simply easier to learn, provides a detailed onboarding process, and is very intuitive. If your accounting software doesn’t register changes in real time, it could lead to costly delays.

Payroll

Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

Using the data we gathered from this case study, we are able to compare QuickBooks Online and Desktop across several key categories, such as pricing, ease of use, general features, A/P, A/R, and banking. We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights.

QuickBooks Desktop is preferable for companies wanting to manage their books without an internet connection. It’s also the better option for businesses requiring complex inventory accounting features. We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits.

Choose the QuickBooks Desktop or Online solution for you

While QuickBooks restaurant bookkeeping and accounting explained Online offers project management features, it doesn’t have the same level of customization options as QuickBooks Desktop. For instance, QuickBooks Desktop allows you to create customized job costing reports tailored to specialized industries, including manufacturers, contractors, and retailers. We developed an internal case study to evaluate the accounting software we review subjectively.

- QuickBooks Desktop wins this head-to-head competition, with better reporting, industry-specific features, a better price structure, and more comprehensive features.

- Zapier is a no-code automation tool that lets you connect your apps into automated workflows, so that every person and every business can move forward at growth speed.

- We deliver timely updates, interesting insights, and exclusive promos to your inbox.

- Offers four plans to accommodate a range of businesses with different needs; each plan limits the number of users, though.

QuickBooks Online vs. QuickBooks Desktop at a glance

The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Meanwhile, QuickBooks Online provides some customization options for businesses, but they’re not as extensive as those in Enterprise. For instance, you can set up QuickBooks Online for nonprofits by adjusting the settings, customizing sales forms, and creating a chart of accounts based on Form 990. In both QuickBooks Online and Desktop, you can assign costs to your inventory items and accounts payable solutions track the quantities sold to calculate the cost of goods sold (COGS).

Going completely cloud-based comes with marginally higher security risks. While QuickBooks Online does offer security features like multi-factor authorization and encrypted data storage, it’s accessible by anyone with employee login credentials and an internet connection. If you go with QuickBooks Desktop Pro or Premier, a how to calculate net pay payroll add-on is available for an additional monthly fee.

Upon opening QuickBooks Desktop, we found that the general layout didn’t differ too much from that of QuickBooks Online. For instance, there were tabs for inventory tracking, job costing and industry-specific reporting. That being said, large businesses may be ok with sacrificing some ease of use for advanced capabilities.

In the cash method of accounting, you record the transaction only when the money has actually changed hands. So, even though you received an invoice in January, you’d record the expense as a cash transaction in February, on the date that it was paid. Profit and loss statements is a recap of your business expenses, costs and revenues on specific dates. Take some time to set up an invoicing system, including tracking the work completion, deciding the frequency of invoicing, defining payment methods and creating professional-looking invoices. If you have mistakes to fix or transactions to track down, don’t stress.

Record transactions

As you balance Accounts Receivable against Accounts Payable, the result is your net income. Divide this amount by net sales amount to obtain your profit margin. If job commitment the ratio of income to debt is small, you’re operating with a narrow profit margin. Analyze where you can cut some costs, and you can improve a narrow profit margin. You can also track your gross margin weekly, biweekly, or monthly based on your sales. GAAP stands for Generally Accepted Accounting Principles, which are the best methods you can use to track and manage your business financials.

How to Keep Books for a Small Business: 13 Tips to Follow

Most of the time, a qualified professional can correct or document these errors. Efficient bookkeeping involves foresight, meaning that a business should always plan for upcoming financial events, including tax time. Good preparation and documentation are critical for paying taxes (including payroll taxes) on time. The income statement is a holistic report that shows revenue and expenses over a set period of time. It can be produced for one period to gain insight into the month’s profitability, or produced for the year to period.

Cash-Based Accounting

For example, if you make a $30 sale, in the double-entry system that transaction could be recorded as a gain in your income ledger, and as a deduction to the total value of your inventory. As a business owner, you’ll most likely have to create a complete financial report at least once a year, for tax purposes. However, there are plenty of reasons to make quarterly, or monthly financial statements as well. Frequent financial reports are a great way to check on your budget, and figure out where you can make adjustments if necessary.

- Accordingly, the information provided should not be relied upon as a substitute for independent research.

- Here are some of the most frequently asked questions on bookkeeping for small businesses.

- Organize your receipts (including receipts for charitable contributions) and accurately record deposits.

- Accrual basis accounting records those invoices and bills even if the funds haven’t been exchanged.

- In single-entry bookkeeping, each transaction is recorded as a single entry in a ledger, while in double-entry bookkeeping, a transaction is recorded twice.

- Budget your business for the future to avoid unnecessary stress and surprises.

If not done at the time of the transaction, the bookkeeper will create and send invoices for funds that need to be collected by the company. The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable). When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account.

Based on the monthly sales, set aside some money to pay for your taxes. This will help you avoid having to outlay a significant amount of funds at the end of the year. The information you adjusting the inventory account get from your receipts should go into some kind of ledger (usually a digital option).

Keeping track of bookkeeping tasks as a small business owner can be challenging. You have to know the ins and outs of your business expenses and all your personal and business finances. The accrual accounting method records financial transactions when they occur understand loan options rather than when cash exchanges hands. But the best way to keep up with your accounts is by scheduling consistent times designated for balancing the books. An easy practice is to set aside a block of time whenever your credit card statement is due and combing through that month’s transactions to ensure they are accurate.

Extend credit on moderate terms, if needed and make sure to document everything to pursue payment through a collection agency or the court. Tracking and reviewing your income and expenses can help you assess the health of your business and plan for future growth. You can follow our guide on how to make an income statement to accurately evaluate your business’s financial health.

They operate under a Software as a Service (SaaS) model, meaning users can access and use the software via the internet, often through a web browser. Online accounting software is a type of application hosted on remote servers providing financial tools like billing, invoicing, and reporting. Unlike Xero, FreshBooks, or QuickBooks Online, Zoho Books offers a free plan for one user and one accountant. However, it doesn’t have a built-in payment gateway, so you’ll need to integrate with third-party services. We also found Zoho apps quite interdependent; if you need more than just Zoho Books and Zoho Inventory, you’re better off getting the Zoho One bundle for full functionality. Even a freelancer or solopreneur will benefit from accounting analytics that capture the financial health of their business.

The comprehensive package includes help with accounting, invoicing, payroll, benefits and expense-tracking needs. Any data that can be stored on a computer can be stored in a cloud accounting application. Businesses can store anything from proposals and quotes to accounts payable and receivable files. You can also store documents, spreadsheets, audio, and video in any sort of cloud storage so that they are accessible to you when you need them.

Is cloud accounting the future?

Neat is a good choice for self-employed entrepreneurs who need an easy-to-use accounting software to organize their financial documents. Each report offered a description and useful information to help me interpret the report when I hovered over the question mark in the top corner of each report. I could also access filters on reports by pushing the down arrow at the top right-hand corner of each report. Filters allowed me to sort reports by time period, including a custom date range. Once I filled in the form using drop-down selections or by manually entering text into the field, I simply had to click “approve and email” to send it. On the “projects” page, I clicked on “create new” and was given the option to create a flat-rate or hourly project.

- SAP (statutory accounting principles) accounting software can be based on the cloud but also can be run on a private network or system.

- One particularly notable feature set within AccountEdge is its data management and report customization features.

- When it comes to the cost of traditional accounting software, you are responsible for maintaining your servers, increasing your storage capacity through investing in new servers, and updating your software.

- You might want to give your business partner or provide the accountant with full access to your account, for example, while only enabling the subordinates to track their time and invoice customers.

Next Up In Business

The downside to the free software is the fact it is not as robust as many of its competitors in the cloud accounting software space. Basic features such as inventory management features, customer support, expansive tax services and time tracking, are not available through Wave. FreshBooks offers a straightforward approach to managing finances, making it exceptionally accessible for beginners and established businesses alike. With a clear interface and features such as easy invoicing, expense tracking and timekeeping, users can navigate their financial tasks without a steep learning curve. capex vs revenue expenditure: definition overview examples updated The platform prioritizes simplicity, ensuring that even those with minimal accounting experience can maintain accurate and organized records.

Benefits of Cloud-Based Accounting Solutions

In terms of accounting capabilities, Odoo includes features like easy cost tracking, recurring invoice management, and auto-synchronization of bank feeds. It supports multiple currencies and payment methods like credit cards, digital wallets, and online banking. Odoo connects with over 15,000 banks worldwide, making transaction management simpler. We prioritized software that was either low-cost or had an affordable plan in a series of pricing plans. We also gave credit to those apps that either provided users with a free version of the software or at least a free trial period. why isn’t land depreciated When considering the affordability of cloud accounting software, many providers have promotions going where the software is greatly reduced for a brief period, then goes up in price.

Online accounting software pricing can vary widely based on several factors, reflected in the monthly subscription rates that range from as low as $9 to upwards of $375 per user. This is influenced by various elements like user count, required functionality and features, and the scale of business operations. We appreciated Intacct’s sophisticated general ledger, which includes a multidimensional chart of accounts. This feature helps manage intricate financial operations across multiple entities, best for international organizations. The real game changer is the ability to merge data, manage currency conversions, and generate consolidated reports without waiting for month-end closings.

Xero is a great option for large teams and SMBs looking for accounting software that multiple team members can use. Freelancers and entrepreneurs who want an affordable plan might want to look elsewhere simply because of its basic plan’s limitation on the number of invoices. Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses.

One particularly notable feature set within AccountEdge is its data management and report customization features. You can customize hundreds of reports and use filters, report fields and custom lists to see only the data you need. financial structures chapter r20b You can also create graphs, charts and maps to create easily consumable reports. The software allows you to then back up your data even daily to ensure it is safe and never lost.

The quick ratio—or “acid test ratio”—is a closely related metric that isolates only the most liquid assets such as cash and receivables to gauge liquidity risk. In mergers or very fast-paced companies, agreements can be missed or invoices can be processed incorrectly. Working capital relies heavily on correct accounting practices, especially surrounding internal control and safeguarding of assets.

How to Reconcile Working Capital on Cash Flow Statement

The Working Capital Turnover is a ratio that compares the net sales generated by a company to its net working capital (NWC). In other words, there are 63 days between when cash was invested in the process and when cash was returned to the company. In short, the amount of working capital on its own doesn’t tell us much without context. Noodle’s negative working capital balance could be good, bad or something in between. If all of Noodles & Co’s accrued expenses and payables are due next month, while all the receivables are expected 6 months from now, there would be a liquidity problem at Noodles. When it comes to modeling working capital, the primary modeling challenge is to determine the operating drivers that need to be attached to each working capital line item.

Beyond AI – Discover our handpicked BI resources

Working capital is a fundamental part of financial management, which is directly tied to a company’s operational efficiency and long-term viability. At the end of 2021, Microsoft how to easily write a promissory note for a personal loan to family or friends (MSFT) reported $174.2 billion of current assets. This included cash, cash equivalents, short-term investments, accounts receivable, inventory, and other current assets.

Working Capital Calculation Example

- The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

- It is the money a business has available to spend on its operations after paying off its bills and short-term debts.

- This gives you more spending flexibility and can help avoid financial trouble.

The organisation may produce more sales for every utilised or employed rupee. On the other hand, a lower working capital turnover ratio indicates a greater working capital quantity and subpar turnover, or the turnover is below the required thresholds based on the specific working capital utilised. An extremely high working capital turnover ratio can indicate that a company does not have enough capital to support its sales growth; collapse of the company may be imminent. This is a particularly strong indicator when the accounts payable component of working capital is very high, since it indicates that management cannot pay its bills as they come due for payment. The interpretation of the working capital turnover ratio depends on the specific circumstances and industry benchmarks. In general, a higher ratio indicates better efficiency in utilizing working capital, while a lower ratio may signify room for improvement.

Everything You Need To Master Financial Modeling

Finding out how your number stacks up against competitors can push you to design more efficient uses for your working capital. Company B, on the other hand had $750,000 in sales and $125,000 in working capital, resulting in a working capital turnover ratio of 6. Company B spent its working capital only six times throughout the year to generate the same level of sales as Company A. Since GE and UTX are competitors, working capital turnover ratio can be used to compare their asset utilization. UTX is clearly using its investment in working capital more efficiently as indicated by its higher working capital turnover ratio when compared to GE’s ratio.

The working capital turnover indicator may also be misleading when a firm’s accounts payable are very high, which could indicate that the company is having difficulty paying its bills as they come due. In this case, the retailer may draw on their revolver, tap other debt, or even be forced to liquidate assets. The risk is that when working capital is sufficiently mismanaged, seeking last-minute sources of liquidity may be costly, deleterious to the business, or in the worst-case scenario, undoable. In this perfect storm, the retailer doesn’t have the funds to replenish the inventory that’s flying off the shelves because it hasn’t collected enough cash from customers. For example, they’d need to borrow, sell equipment, or liquidate inventory (i.e. convert into cash on hand).

Characteristics and Financial Ratios of the Wholesale Retail Industry

To bring context and to see why this metric is so important for measuring business efficiency, let’s take a look at a few examples. It’s worth mentioning know that just because you have working capital at your disposal doesn’t guarantee that you’ll be using it effectively. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

For example, a manufacturing company may have a lower working capital turnover ratio compared to a service-based business due to the higher inventory and accounts receivable turnover. Therefore, it is crucial to analyze the ratio in the context of the specific business and industry. The working capital ratio remains an important basic measure of the current relationship between assets and liabilities. In financial accounting, working capital is a specific subset of balance sheet items, and calculated by subtracting current liabilities from current assets.

SaaS startups can get up to $4M of non-dilutive revenue-based financing from Lighter Capital that adapts to the ebbs and flows of the business. Say Company A had net sales of $750,000 last year and working capital of $75,000. Company A’s working capital turnover ratio is 10, which means the company spent that $75,000 ten times to generate its $750,000 in sales. This can happen when the average current assets are lower than the average current liabilities. The working capital turnover ratio is a metric that helps us analyze the efficiency of the company in generating revenue using its working capital.

As working capital is the money a company uses to run its daily operation, a company with negative working capital is not likely to last long. For instance, an NWC turnover ratio of 3.0x indicates that the company generates $3 of sales per dollar of working capital employed. However, unless the company’s NWC has changed drastically over time, the difference between using the average NWC value and the ending balance value is rarely significant. In practice, the working capital turnover metric is a useful tool for evaluating how efficiently a company uses its working capital to produce more revenue. Your working capital ratio is only a small piece of your overall financial health and profitability.

When you are good at managing capital, you also have a strong cash conversion cycle (CCC). This means that you can convert assets and liabilities into revenue (cash) quickly. Is the working capital turnover ratio the same as the inventory turnover ratio? No, the working capital turnover ratio measures the efficiency of working capital utilization, while the inventory turnover ratio specifically focuses on the efficiency of inventory management. Both ratios provide valuable insights but assess different aspects of a company’s operations.

The average balances of the company’s net working capital (NWC) line items – i.e. calculated as the sum of the ending and beginning balance divided by two – are shown below. If a company’s turnover ratio is trailing behind its peers, this may be a sign it may need to further optimize its operational practices, as its sales are insufficient compared to the amount https://www.adprun.net/ of working capital put to use. To calculate the turnover ratio, a company’s net sales (i.e. “turnover”) must be divided by its net working capital (NWC). The working capital turnover ratio may also be misleading when a business is Accounts Payable are incredibly high. This may indicate that the company is having difficulty paying bills as they come due.

It is essential to look beyond the number at the underlying story and ask why the ratio is the way it is and what can be done to improve it. Additionally, businesses need to ensure that they make comparisons with companies in their industries, taking note of the differences in operations across various sectors. Imagine that in addition to buying too much inventory, the retailer is lenient with payment terms to its own customers (perhaps to stand out from the competition). This extends the amount of time cash is tied up and adds a layer of uncertainty and risk around collection. Conceptually, the operating cycle is the number of days that it takes between when a company initially puts up cash to get (or make) stuff and getting the cash back out after you sold the stuff.

Because it indicates you use your working capital more times every year, the idea is that money is flowing in and out of your business quite well. Because of this, you have more spending flexibility which helps to avoid financial trouble. If you experience a higher demand for all your products, you are not as likely to suffer inventory shortages that sometimes accompany rising sales. Say that Red Company had a net sales of $500,000 last year and working capital of $50,000.

As an accountant character in one of my favorite (if little known) movies says, “Stop risking your money and start frisking your money! ” I have a feeling that improving your working capital turnover ratio would be exactly what he means. Yet just having working capital at your disposal doesn’t guarantee that you’ll be making effective use of this essential resource.

It’s typically considered a good thing to redeploy your working capital more times per year to gain your year’s net sales figures. It means that money is easily flowing in and out of your business and is working to make you more money. Put together, managers and investors can gain critical insights into the short-term liquidity and operations of a business.

The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result. Working capital is the lifeblood of any business, representing the funds available for daily operations and short-term obligations. Efficient management of working capital is crucial for the smooth functioning and financial health of a company.

The simple payback period doesn’t take into account money’s time value. The difference between both indicators is

that the discounted payback period takes the time value of money into account. This means that an earlier cash flow has a higher value than a later cash flow

of the same amount (assuming a positive discount rate). The calculation

therefore requires the discounting of the cash flows using an interest or

discount rate.

In other words, the investment will not be recovered

within the time horizon of this projection. The initial outflow of cash flows is worth more right now, given the opportunity cost of capital, and the cash flows generated in the future are worth less the further out they extend. The shorter the discounted payback period, the quicker the project generates cash inflows and breaks even. While comparing two mutually exclusive projects, the one with the shorter discounted payback period should be accepted. Prepare a table to calculate discounted cash flow of each period by multiplying the actual cash flows by present value factor.

- The discounted payback period is a measure

of how long it takes until the cumulated discounted net cash flows offset the

initial investment in an asset or a project. - As a general rule of thumb, the shorter the payback period, the more attractive the investment, and the better off the company would be.

- The next step is to subtract the number from 1 to obtain the percent of the year at which the project is paid back.

- In this example, the cumulative discounted

cash flow does not turn positive at all.

You should also consider factors such as money’s time value and the overall risk of the investment. The payback period disregards the time value of money and is determined by counting the number of years it takes to recover the funds invested. For example, if it takes five years to recover the cost of an investment, the payback period is five years.

Advantages and disadvantages of payback method:

The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it. Investors may use payback in conjunction with return on investment (ROI) to determine whether or not to invest or enter a trade. Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV.

First, we’ll calculate the metric under the non-discounted approach using the two assumptions below. The sooner the break-even point is met, the more likely additional profits are to follow (or at the very least, the risk of losing capital on the project is significantly reduced). In real-life scenarios, depreciation is considered as it is unlikely an operating machine would remain optimal for an extended period.

Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible. Average cash flows represent the money going into and out of the investment. Inflows are any items that go into the investment, such as deposits, dividends, or earnings. Cash outflows include any fees or charges that are subtracted from the balance. In any case, the decision for a project option or an investment decision should not be based on a single type of indicator.

Example of the Discounted Payback Period Formula

One of the disadvantages of discounted payback period analysis is that it ignores the cash flows after the payback period. Thus, it cannot tell a corporate manager or investor how the investment will perform afterward and how much value it will add in total. But there are a few important disadvantages that disqualify the payback period from being a primary factor in making investment decisions. First, it ignores the time value of money, which is a critical component of capital budgeting. For example, three projects can have the same payback period; however, they could have varying flows of cash. The breakeven point is the price or value that an investment or project must rise to cover the initial costs or outlay.

Despite these limitations, discounted payback period methods can help with decision-making. It’s a simple way to compare different investment options and to see if an investment is worth pursuing. The payback period value is a popular metric because it’s easy to calculate and understand. However, it doesn’t take into account money’s time value, which is the idea that a dollar today is worth more than a dollar in the future. The discounted payback period (DPP) is a success measure of investments and projects. Although it is not explicitly mentioned in the Project Management Body of Knowledge (PMBOK) it has practical relevance in many projects as an enhanced version of the payback period (PBP).

Example of the Discounted Payback Period

Have you been investing and are wondering about some of the different strategies you can use to maximize your return? There can be lots of strategies to use, so it can often be difficult to know where to start. But aside from a https://simple-accounting.org/ strategy, there are other scenarios you can leverage. Suppose a company is considering whether to approve or reject a proposed project. We’ll now move to a modeling exercise, which you can access by filling out the form below.

The discounted payback period is a good

alternative to the payback period if the time value of money or the expected

rate of return needs to be considered. If DPP were the only relevant indicator,

option 3 would be the project alternative of choice. There are two steps involved in calculating the discounted payback period. First, we must discount (i.e., bring to the present value) the net cash flows that will occur during each year of the project. Company A has selected a project which costs $ 350,000 and it expects to generate cash inflow $ 50,000 for ten years. Under payback method, an investment project is accepted or rejected on the basis of payback period.

Payback Period Calculation Example

The discounted payback method tells companies about the time period in which the initial investment in a project is expected to be recovered by the discounted value of total cash inflow. Additionally, it indicates the potential profitability of a certain business venture. For example, if a project indicates that the funds or initial investment will never be recovered by the discounted value of related cash inflows, the project would not be profitable at all. The company should therefore refrain from investing its funds in such project. The payback period is the time it takes an investment to break even (generate enough cash flows to cover the initial cost). Certain businesses have a payback cutoff which is essential to consider when proceeding with investment projects.

The project has an initial investment of $1,000 and will generate annual cash flows of $100 for the next 10 years. The discounted payback period is often used to better account for some of the shortcomings, such as using the present value of future cash flows. For this reason, the simple payback period may be favorable, while the discounted payback period might indicate an unfavorable investment.

Given a choice between two investments having similar returns, the one with shorter payback period should be chosen. Management might also set a target payback period beyond which projects are generally rejected due to high risk and uncertainty. The payback period is a fundamental capital budgeting tool in corporate finance, and perhaps the simplest guidelines for a letter of intent method for evaluating the feasibility of undertaking a potential investment or project. It is calculated by taking a project’s future estimated cash flows and discounting them to the present value. Therefore, we are comparing the investment’s initial capital outlay. Payback period is the amount of time it takes to break even on an investment.

We see that in year 3, the investment is not just recovered but the remaining cash inflow is surplus. The initial investment of the company would be recovered in 2.5 years. The project is acceptable according to simple payback period method because the recovery period under this method (2.5 years) is less than the maximum desired payback period of the management (3 years). The faster a project or investment generates cash flows to cover the initial cost, the shorter the discounted payback period.

Second, we must subtract the discounted cash flows from the initial cost figure in order to obtain the discounted payback period. Once we’ve calculated the discounted cash flows for each period of the project, we can subtract them from the initial cost figure until we arrive at zero. According to payback method, the project that promises a quick recovery of initial investment is considered desirable.

Our team of expert consultants is certified in QuickBooks costs, ensuring financial peace of mind for your construction business. We create and monitor construction industry-specific key performance indicators. KPIs include profit margin, job cost variance, resource usage, and revenue growth can help you assess project success. Further, KPIs allow you to measure the success of your endeavors and make informed choices.

Tip 9: Backup your records

- This helps make sure that information is current and that nothing is forgotten.

- Construction software becomes a one-stop platform for everything from prices to contracts and compliance.

- Apart from giving you insight into where your money is going, receipts also serve as proof of your business expenses in case you ever get audited.

- Armed with this data, you can make informed decisions about pricing, resource allocation, and bidding on future projects, all of which contribute to the long-term profitability of your business.

- We have the capabilities and experience to cater to the demands of any construction company, no matter how big or small.

- This helps identify any cost overruns early, enabling contractors to take corrective actions.

Most small contractors can’t justify a full time, experienced office employee. Construct Bookkeeping is here to help as a local firm assisting construction contractors with remote bookkeeping, payroll and tax deadlines. By taking these tasks off your plate, you have more time to spend in the field focusing on projects.

The Significance of Construction Bookkeeping for Streamlining Projects

We keep extensive records of all construction-related financial transactions in an organized general ledger system. Our seasoned construction bookkeepers will meticulously record your company’s revenue and expenditures in the general ledger. We record every project detail, from project codes to cost categories to job details of the specific task. Finally, you want to find a solution that you can customize if you have special reporting or processing needs. This may be relevant for larger companies that have multiple projects that they manage simultaneously and need to create comprehensive reports and cash flow data for stakeholders. Not only do you and your employees need to feel comfortable using the system but so do clients and subcontractors if you integrate them into the bidding and project management process.

Connect With A Member Of Our Bookkeeping Team

- Job costing is a process that helps you determine the costs of working on a project.

- We provide a complete picture of each project’s financial health by correctly attributing expenses to their jobs or projects.

- That’s why so many in the industry are now on the lookout for the best accounting software for construction.

- Bookkeeping and accounting are essential for any construction business in the US.

- If needed, we implement new processes to ensure you are getting the best data possible.

- It consists of tax laws, labor rules, and standards unique to a given industry.

Balance sheets, income & cash flow statements are just some of the financial reports we prepare as part of our financial reporting services. Regarding bookkeeping for construction companies, proper classification is crucial for tracking costs and profits corresponding with various projects, cost centers, and departments. Each entry will be coded appropriately according to your specifications since our bookkeepers thoroughly grasp construction accounting fundamentals.

We looked at a total of 22 different metrics across five separate categories to reach our conclusion. Here are some of the categories we used to rank the providers that made the top of the list. Take a look at the customer support offerings when browsing construction accounting software. These experts also support keeping The Importance of Construction Bookkeeping For Streamlining Business Operations proper records for union agreements, verified payroll, and insurance. Specialized construction bookkeeping services help minimize the risk of audits, penalties, and legal complications.

Ai assisted receipt capture and bill triage for DIY’ers or accounting teams. Perfect 2-way sync with Quickbooks.

With your dedicated QuickBooks for construction bookkeeper, you’ll have access to detailed reports for insights into your business’s performance. Our Quickbooks consulting services organizes your chart of accounts, ensuring proper categorization of past transactions. This results in updated books and alleviates any financial stress you may have experienced. In addition, we help you find and make the most of tax deductions and credits that apply to your construction sectors, such as those for investments in energy efficiency, R&D, and other areas. We help you meet all your tax responsibilities, such as submitting filings accurately and on time, disclosing your income, and making tax payments. Our tax specialists offer holistic tax planning services tailored-made to your unique needs, allowing you to reduce your tax burden while maintaining a positive standing with the tax authorities.

Outbooks – Your Truster Partner of Bookkeeping for Construction Companies!

Our expert bookkeeping services have transformed the financial operations of our clients. It means we’re all about being adaptable, agile and highly dependable.We don’t play favorites with software when it comes to providing top-notch accounting and bookkeeping services. We seamlessly adapt to your preferred software, giving you the strategic advantage, the nimbleness you need and the reliability you can count on.

- Whether through cloud-based systems or personalized support, professional construction bookkeeping simplifies operations and drives profitability.

- Invensis offers contractor payroll management services tailored for construction companies, including handling unionized labor and compliance with specific wage requirements.

- Contractor Foreman is great for smaller to medium-sized businesses looking for an all-in-one tool to manage projects, track costs, and keep accurate financial records.

- For example, suppose your company uses progress billing on large jobs (where each invoice is charged against the total cost of the job over time until the balance is paid).

- Daily construction bookkeeping and controller services for real-time decision making.

- FreshBooks contractor accounting software programs strike the ideal balance between ease of use and functionality.

- Infrastructure projects like roads, bridges, and utility installations require careful tracking of large-scale equipment costs, labor, and materials.

- Dave Nevogt is an American entrepreneur and the co-founder of Hubstaff, a workforce management software company.

- Irregular payment cycles, retentions, and upfront costs are common in the construction industry.

- At NorthStar Bookkeeping, we’re more than just a bookkeeping service; we’re your financial partner.

- She brings practical experience as a business owner and insurance agent to her role as a small business writer.

- They ensure timely filings and minimize the risk of penalties by staying up to date with tax regulations.

With the https://blackstarnews.com/detailed-guide-for-the-importance-of-construction-bookkeeping-for-streamlining-business-operations/ completed contract method, you recognize revenue only after completing a project. Construction companies often use this method for short-term contracts, especially those where contract costs can be hard to estimate. Milestone payments are payments paid out after achieving a defined stage of progress on a project.

If you need a simpler way to create and keep up with what seems like a million and one invoices, Freshbooks may be the tool for you. It offers a greater level of customization than most other accounting software, and it requires little to no experience to use. Upgrade to our Bookkeeping and Tax plan, and you’ll also benefit from unlimited tax advisory services, tax strategy planning, and annual tax filing. Not only can you get back hours of your life with a hands-off bookkeeping and accounting solution, but you can rest easy knowing that your books are error-free. Here are the top eight bookkeeping and accounting software options to look into for your small business.

While QuickBooks Online wins our top spot for now, we’re hoping that as Xero’s user base expands, more accountants and bookkeepers will sign on. That should make collaboration easier for Xero-using small-business owners who (wisely!) work with financial advisors around tax time. And thousands of accountants and bookkeepers do use Xero already, so you can search Xero’s directory to find a local accountant maginal costing who’s already familiar with the software. FreshBooks listened, adding a ton of new features in recent years, including the addition of double-entry accounting capability.

Can I use accounting software with payroll software?

- Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager.

- Leveraging my accounting and bookkeeping expertise, I rigorously assess software using our internal case study that objectively scores key features while upholding editorial independence.

- A good small business accounting service gives you information that helps you answer these questions based on the input you supply.

- If you have connected your financial accounts to your accounting tool, then it’s easy to do.

- Unless you purchase Advanced, you can’t place a direct phone call to an agent; you need to send a ticket first and wait for a call.

You can create a quote and then convert it into an invoice when the customer is ready to buy. You can convert the quote and bill by a percentage of the original quote or a set quantity, rate or amount. And, you can attach documents to the invoice when needed, including warranties, contracts and return policies.

For features and functionality, we primarily looked for software that offered fully functional accounting software providing users with a long list of useful features. Neat just has one pricing plan making it easy for business owners who have a hard time deciding on which plan to choose. For $200 per year, users can have access to features like unlimited real-time reports such as profit and loss (P&L) statements, cash flow statements, balance sheets and transaction reports. Users can also create and send custom invoices, secure payments through WePay and provide accountants with access. The plan also comes with unlimited storage, unlimited access to personalized support at no additional cost and a mobile app to upload and match receipts to expenses in real time. TrulySmall Accounting is full accounting software for small businesses for $18 per month.

Accessing all included tools using the left-hand menu was easy, as it’s a menu that is always how to calculate net sales present no matter where I navigated on the platform. Once I clicked a menu tab, all the tools I needed to use to complete relevant tasks were included in the resulting page. From there, once I landed on the dashboard, I received a checklist of items to complete account setup and customization. I could also access a continually updating list of shortcuts to tools I most use in the platform. Like Xero and QuickBooks, Sage Business Accounting’s reports are user friendly and very easy to read.

Zoho Books

At its core, it offers dynamic invoicing capabilities allowing businesses to generate bespoke online invoices tailored to their specific requirements. This adaptability extends to bank connections, integrating with over 9,600 financial institutions across the U.S. and Canada. This ensures that businesses have a singular view of their finances, with the ability to review, edit and reconcile records efficiently. I didn’t have to spend time trying to figure out where features were because they were in intuitive places within my navigation process. In addition, call-to-action buttons helped me know what I needed to do to customize the platform to my needs, such as adding a bank account or filtering reports.

Creating Accounting Records for Contacts and Products

The companies that make small business accounting software have worked hard to make it as simple and pleasant as possible. Wave, TrulySmall Accounting, and FreshBooks are among the easiest accounting programs to use. Finally, find accounting software that integrates seamlessly with other business software. As your company grows, it might be necessary to integrate multiple types of software to scale the business. Sign up for applications that will work seamlessly with your primary business software. There are some easy-to-use accounting software that don’t require prior bookkeeping experience.

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. Freelancers may want to see our roundup of the best online bookkeeping services bookkeeping basics for freelancers to find a provider that can cater to your bookkeeping needs. Sage 50 scored very well across all the major accounting features that we have in our case study. It’s exceptionally strong in project and inventory accounting, which is why it received a perfect mark in the category.

Buying Guide: The Best Accounting Software for Small Businesses in 2024

Kashoo is a great choice for small business owners who want straightforward accounting software that is easy to set up. Xero is a great option for large teams and SMBs looking for accounting software that multiple team members can use. Freelancers and entrepreneurs who want an affordable plan might want to look elsewhere simply because of its basic plan’s limitation on the number of invoices. There are many terrific small business accounting software applications available, but none of them are as versatile and comprehensive as QuickBooks Online. However, it isn’t always the best solution, especially if you only have very basic needs and wish to save money.

Moreover, Sage 50’s mobile app captures receipt images but nothing else, and its ease of setup and ease of use is about what we expect for a desktop program. The main advantage of upgrading to the Pro tier is that it supports unlimited users, which can be useful for small businesses or freelancers working with a team. The most important added feature, available even in the free tier, is automatically importing and categorizing your expenses from a bank feed—something nice but not necessary. OneUp offers several standout features, including extensive automations that extend across business functions, customized and automated invoicing, a comprehensive mobile app and extensive reporting. “Staying compliant with global tax regulations can be a challenge, but NetSuite simplifies this area considerably by ensuring things like calculating and remitting VAT are properly addressed without too much busywork. It also offers strong budgeting functionality to assist with financial planning.