Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. The balance in dividends, revenues https://www.simple-accounting.org/ and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

- If we expand the view, we’ll find the usual suspects—the temporary accounts.

- The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made.

- This process resets both the income and expense accounts to zero, preparing them for the next accounting period.

- This step is completed after the financial statements have been prepared.

Step #1: Close Revenue Accounts

You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

Ask Any Financial Question

If dividends were not declared, closing entries would cease atthis point. If dividends are declared, to get a zero balance in theDividends account, the entry will show a credit to Dividends and adebit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends. The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend. The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made.

Step 4: Close withdrawals account

Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero. By doing so, the company moves these balances into permanent accounts on the balance sheet. These permanent accounts show a company’s long-standing financials. Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account. Essentially resetting the account balances to zero on the general ledger.

Part 2: Your Current Nest Egg

But if the business has recorded a loss for the accounting period, then the income summary needs to be credited. This means that it is not an asset, liability, stockholders’ equity, revenue, or expense account. The account has a zero balance throughout the entire accounting period until the closing entries are prepared. Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements. Accountants may perform the closing process monthly or annually.

Step 1 of 3

When the income statement is published at the end of the year, the balances of these accounts are transferred to the income summary, which is also a temporary account. If the income summary account has a credit balance, it means the business has earned a profit during the period and increased its retained earnings. The income summary account is, therefore, closed by debiting the income summary account and crediting the retained earnings account. You might be asking yourself, “is the Income Summary accounteven necessary? ” Could we just close out revenues and expensesdirectly into retained earnings and not have this extra temporaryaccount? We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time.

Do you own a business?

The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses (Figure 5.5). A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. All revenue accounts are first transferred to the income summary. Here you will focus on debiting all of your business’s revenue accounts. If your business is a sole proprietorship or a partnership, your next step will be to close your income summary account.

To get a zero balance in the Income Summary account, there are guidelines to consider. That’s why most business owners avoid the struggle by investing in cloud accounting software instead. The following example of closing entries will assist you in quickly comprehending closing account receivable turnover definition entries. When preparing closing entries, there are a few things to bear in mind. This follows the rule that credits are used to record increases in owners’ equity and debits are used to record decreases. It’s vital in business to keep a detailed record of your accounts.

Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand.

Adjusting entries are used to modify accounts so that they’re in compliance with the accrual concept of recording income and expenses. We at Deskera offer the best accounting software for small businesses today. Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary.

One of the most important steps in the accounting cycle is creating and posting your closing entries. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. The income statement summarizes your income, as does income summary.

Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

The amount of sales discount is deducted from the gross sales to calculate the company’s net sales and recorded in a separate sales discount account. However, a company may decide to simply present its net sales in its income statement, rather than breaking out the sales discount and gross sales separately. This is usually common when the amount of sales discount is so small that a separate presentation does not yield any material additional information for the reader of the financial statement. Most businesses do not offer early payment discounts, so there is no need to create an allowance for sales discounts. As you can see in this entry, $750 is the sales discount or cash discount which is recorded as expenses and the company received cash only $24,250.

A company may choose to simply present its net sales in its income statement, rather than breaking out the gross sales and sales discounts separately. This is most common when the sales discount amount is so small that separate presentation does not yield any material additional information for readers. A sales discount is a reduction in the price of a product or service that is offered by the seller, in exchange for early payment by the buyer.

Initial Recognition of Sales Transaction:

A contra-revenue account allows the company to see the original amount sold and also see the items that reduced the sales to the net sales amount. Sales Discounts as well as Sales Returns and Allowances are all examples of contra-revenue accounts. Let’s look at some examples of sales discount as a contra revenue account and how it is recorded as a debit contrary to the natural credit balance of revenue. Sales discounts are not only beneficial to the company, but it also benefits the buyer too.

- Sales Returns Account, Sales Allowances Account, and Sales Discounts Account are the three commonly used contra revenue accounts.

- Therefore, its debit balance will be one of the deductions from sales (gross sales) in order to report the amount of net sales.

- The amount of sales discount is deducted from the gross sales to calculate the company’s net sales and recorded in a separate sales discount account.

- The total sales discounts are then subtracted from the gross sales revenue that has been earned in the period before accounting for discounts.

There are four main types of contra accounts such as contra asset, contra revenue, contra liability, and contra equity. The contra revenue is a reduction from the gross revenue that a business reports, which results in net revenue. Contra-revenue transactions are reported in one or more contra-revenue accounts, that normally have a debit balance contrary to the credit balance in the typical revenue account. Sales Returns Account, Sales Allowances Account, and Sales Discounts Account are the three commonly used contra revenue accounts.

In the header bar of the invoices issued, the seller usually states the standard condition at which the sales discount may be taken by the customer. Nonetheless, it is usually advisable to use a revenue account and a contra-revenue account when recording sales. The revenue account reports the value of an original sale while the contra revenue account reports the details of any discounts, returns and allowance that reduces the value of the original sale.

Then, when the customer actually takes the discount, you charge it against the allowance, thereby avoiding any further impact on the income statement in the later reporting period. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. An example of a sales discount is for the buyer to take a 1% discount in exchange for paying within 10 days of the invoice date, rather than the normal 30 days (also noted on an invoice as “1% 10/ Net 30” terms).

Therefore, its debit balance will be one of the deductions from sales (gross sales) in order to report the amount of net sales. Sales discounts as a contra-revenue account are expected to have a debit balance rather than the usual credit balance of revenue. This means that the expected balance of sales discount is contrary to, or opposite of, the usual credit balance in a revenue account. That is, a sales discount is a contra-revenue account that takes into account the value https://www.quick-bookkeeping.net/invoice-templates-in-adobe-illustrator/ of price reductions that are granted to buyers or customers in order to encourage early payments. The sales discounts account is presented on the income statement as a contra-revenue account, that offsets gross sales, which results in a smaller net sales figure. As seen in the financial report above, the sales discount as a contra revenue account appears as a $9 reduction from the gross revenue of $900 that the manufacturer reported, which results in net revenue of $891.

How to Manage Accounts Receivable for Services Industry Company?

They appear near the top of the income statement, as a reduction from gross revenue and are thus recorded in a contra-revenue account named Sales Discounts. Therefore, the debit balance of the sales discount will be one of the deductions from sales (gross sales) in order to report the net sales. Sales discount as a contra revenue account is expected to have a debit balance rather than the usual credit balance of revenue. When a sales discount is source documents for accounting transactions offered to few customers, or if few customers take the discount, then the amount of the discount actually taken is likely to be immaterial. In this case, the seller can simply record the sales discounts as they occur, with a credit to the accounts receivable account for the amount of the discount taken and a debit to the sales discount account. The sales discount account is a contra revenue account, which means that it reduces total revenues.

Contra revenue accounts can also be recorded within the sales account, but this means that it will be buried within the total amount of revenue reported, so that management cannot easily determine the amount of contra revenue. If a company has minimal contra-revenue activity, it is understandable to record these transactions within the revenue account. If, for instance, the customer received a 1 per cent discount on the $100 for paying early.

She enjoys writing in these fields to educate and share her wealth of knowledge and experience.

What type of Account is Sales Discounts?

Another common sales discount is “2% 10/Net 30” terms, which allows a 2% discount for paying within 10 days of the invoice date, or paying in 30 days. This term given means that the customer can satisfy the $900 obligation if he pays $891 ($900 – $9 of sales discount) within 10 days. The other alternative is for the customer to pay the full $900 within 30 days. Company ABC sold some pharmaceutical products on credit to Mr John on the 1st of September, 2020 and the total amount on the invoice was $30,000 which he has to pay on or before the 1st of October 2020. Now, if Mr John makes full payment before 15th Sept 2020, a 5% discount will be given. Suppose the XYZ company recorded only one invoice in their accounting period.

Contra revenue accounts are presented separately from the gross sales revenue on an income statement to show the discounts, allowances, and returns that reduced the original total value of the sale to the net amount. This is more informative for the users of financial statements rather than when a net balance is reported only. That is, the reader of the income statement will be able to distinguish between the original amount of sales revenue generated, the sales reduction, and the resulting net amount. Discounts on sales are recorded in a contra-revenue account named Sales Discounts.

When a customer takes advantage of an early payment discount, the amount that was supposed to be paid is reduced by a certain percentage. The disadvantage of this, however, to the seller is that they bear the brunt of lower revenue due to sales discounts. Also, the buyer can be disadvantaged if the cost of funds for the early payment is higher than the sales discounts. In this article, we will discuss what type of account sales discounts is and how it is recorded in the financial statements.

Sales discounts are recorded in a contra revenue account such as Sales Discounts. Hence, its debit balance will be one of the deductions from sales (gross sales) in order to report the amount of net sales. A sales discount is the reduction given to a customer on the invoiced price of goods or services in order to incentivize early payment to the seller. Sales discounts when offered by sellers to customers reduce the amounts owed to the sellers for the goods or services when the customer pays within the stated discount periods.

A Cash or Sales discount is the reduction in the price of a product or service offered to a customer by the seller to pay the due amount within a specified time period. In order to illustrate another example of a sales discount, assume that a manufacturer sells $900 worth of products to its customer and its credit terms are 1/10, n/30. They are the expenses account which is reported in the income statement for the period that the allowance or discount occurs. The total account receivable of $25,000 is discharged from the account receivable balance during the time the customer makes payment.

To see our product designed specifically for your country, please visit the United States site. If you buy goods for $70 and sell them for $100, your cost-to-retail ratio is 70 percent. See our overall favorites, or choose a specific type of software to find the best options for you. Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University.

Save Time & Money

If you prefer desktop over cloud accounting, our best alternative for Sage 50cloud would be QuickBooks Desktop Premier Plus. This limitation is the reason why Xero’s ease of use score is average. Hence, I advise that you choose QuickBooks Online instead for access to a vast network of ProAdvisors. Having a thorough understanding and managing your books well makes running your business much easier.

Retail inventory management: steps for success

Businesses must get special permission from the IRS to change accounting methods, including cost-flow assumptions and inventory valuation approaches. They don’t want taxpayers trying to game the system by switching https://thecupertinodigest.com/navigating-financial-growth-leveraging-bookkeeping-and-accounting-services-for-startupsas-a-startup-owner-you-know-that-the-accounting-often-receives-less-attention-than-immediate-priorities-produc/ constantly. In addition to following a consistent cost flow assumption, retail businesses must use an inventory valuation method to determine their cost of goods sold and the cost of ending inventory.

What does the accounting cycle look like for retail stores?

These three things – assets, liability, and equity – should always balance each other, hence the name of this document. For the above example, you assume that you sold the cheaper dice first. Because the 30 dice at 5 cents each were ordered first, you’ll match this against https://edutechinsider.com/navigating-financial-growth-leveraging-bookkeeping-and-accounting-services-for-startups/ your inventory and assume that 30 of the dice you sold cost 5 cents each. You’ll then assume that the next 20 you sold were from the second order, meaning those dice cost you 7 cents each. Using the same example, let’s say you sell 130 bottles of water for $25 each.

For example, say your retail store’s inventory on January 1 cost $10,000. During the first quarter of the year, you buy more units for $2,500 and have $5,000 in sales. Every product you sell is similar enough that your retail price is always 30% above cost. accounting services for startups Typically, this method is only possible for retail stores with fewer products, higher prices, and lower transaction volume. For example, a car dealership or jewelry shop could keep track of each item in its inventory, but a grocery store generally couldn’t.

Cost of Goods Sold (COGS): Unveiling the True Cost of Your Inventory

- By entrusting FreshBooks with your accounting, you can save both time and money.

- Understanding your cash flow is crucial for managing your cash reserves, planning for future investments, and ensuring you have sufficient funds to meet your ongoing financial obligations.

- With secure online payment solutions and recurring billing, FreshBooks offers solutions that make your customers happy.

- Labor refers to any wages to employees which relate to a specific aspect of producing products or delivering services.

- Having a thorough understanding and managing your books well makes running your business much easier.

While it’s common to have international sources in creating redundancy, some have recommended a combination of overseas and stateside manufacturing. Once your tax returns are reconciled to the books, which can be extremely complex, the next step is to start reconciling the balance sheet. This involves going through each and every balance sheet account and reconciling, which can be quite complex depending on the condition of your books.

Investment Banking Associate

These accountants usually keep ledgers of monthly debits and credits, as well as payment dates that are approaching. Because pharmacies frequently dispense medications that are covered health insurance policies, a pharmacy accountant will almost always need to keep track of this information. The amounts that customers’ insurance plans https://www.bookstime.com/ will pay versus any remaining sums to be paid out-of-pocket to the pharmacy are usually listed on these financial reports. Having accurate, timely and well-formatted data is important, but to make it useful you need to understand how to put the information to work. Our team has decades of experience in owning and operating pharmacies.

The Best Accounting Software for Pharmacy

Proper pharmacy accounting comes down to making sure your books are current, have integrity, and operate efficiently. With this style of accounting, revenue and expenses get recorded in the period when they are earned or incurred. For example, a pharmacy may order products to cover a request made by a customer.

Recurring Invoices

- We formulate a tax strategy throughout the year based on your individual situation.

- There’s of course no way to know exactly which coffee you sold because you just poured it all in the coffee grinder as you needed it.

- The old way of doing accounting is out the door; update to technologies that allow you to stay current and proactive.

- By understanding where you stand compared to your peers, you can have confidence in what you’re doing—and find areas in which you can improve.

- You could also dedicate some of your CPE credits to help you transition into the field.

- Without an accurate inventory figure, you may be grossly overstating or understating your margins and net bottom line.

With this type of accounting, revenue and expenses are recorded when they are essentially earned, like when the sale is made, or when they are incurred, like when products are ordered. With the right accounting services, these concerns can be minimised for you. Cash basis accounting is where revenue and expenses are recorded during the period where the cash was actually received or spent.

You’re signed out

- Let’s look at pharmaceutical accounting and whether it’s right for you.

- Formulating a plan for a pharmacy owner to increase annual profits and reduce unnecessary operating costs is one of their responsibilities.

- This involves going through each and every balance sheet account and reconciling, which can be quite complex depending on the condition of your books.

- Assisting independent pharmacy owners throughout the country with cash flow, financing, profitability and tax compliance.

- Having accurate, timely and well-formatted data is important, but to make it useful you need to understand how to put the information to work.

For a pharmacy, your direct, non-management labour should be included in your cost of goods sold (COGS) accounts. Working with an experienced bookkeeper or accountant to get professional advice before setting this up is always a good idea. Talk to our experienced pharmacy accountants about budgeting and forecasting for your pharmacy business. Let’s say you own a coffee shop and you want to prepare the income statement for December 2016.

Accounting, Taxes, Data Dashboards, Mgt Consulting Bundle

Robust forecasting ensures you’re never caught off guard, especially during peak and unpredictable seasons like winter. Forecasting allows you to make informed decisions about your pharmacy’s future. This past fall I started working on an MBA through West Texas A and M’s distance learning program and the first course I took was accounting, which I had never taken before. Sign up to receive PBA Health’s e-newsletter to get the latest Elements web articles in your inbox every other week, along with industry news, supply chain insights, and exclusive offers. Our program was designed to empower you to take bold yet informed steps in your journey to creating a fulfilling career.

- Preparing, issuing, and recording paychecks on the pharmacy’s designated paydays is a common job duty.

- Financial statements help those in managerial positions in pharmacies to determine which stores or products are profitable and which ones are not.

- FreshBooks offers best-in-class accounting tools designed with your pharmacy in mind.

- Ditch the complicated calculations and time-consuming spreadsheets for a suite of products that works together to offer a streamlined accounting solution to help your pharmacy grow.

- Inventory management and control is vital to the integrity of your financial performance.

- Learn more about the ins and outs of pharmacy ownership from the experts at First Financial Bank.

Tip #3: Record revenue accurately

Accountants must also keep track of any outstanding balances on each customer’s account. These accountants also keep their clients informed about any outstanding business tax liabilities pharmacy accounting that must be paid each year. Maintaining inventory records and preparing payroll checks for the company’s technicians and pharmacists are examples of other accountant responsibilities.

Senior Payroll and Benefits Specialist

Inventory Management In Modern Accounting.

Page numbers are sometimes used in OER classes to direct students to the correct assignment. It is like many other introductory financial accounting textbooks. The book was on financial accounting, which traditionally has served as the building blocks for understanding accounting and finance. When compared to other similar textbooks; although, this book covers many of the same topics the manner in which the book delivered and laid out the concepts was not as clear.

- This text is written in a single voice and allows for consistency through out the entire textbook.

- Add invoice terms, amounts, and payments received to view current and overdue balances.

- The accounting framework is used consistently to measure, recognize, present, and disclose the information appearing in financial statements.

- The sections of the text make it possible to assign various modules and to stop and lecture and problem solve based on those sections.

Templates in Microsoft Excel

There are cost and total columns but you can leave them blank if you don’t know the costs; just fill in “Item No.” and “Description”. To download a form to your device, click or return on common stockholders’ equity ratio explanation formula example and interpretation tap on any of the graphic images below. It can be reused, remixed, and reedited freely without seeking permission.

Accounts Receivable Template

This textbook covers all of the topics normally covered in a principles of financial accounting textbook. There are good learning objectives listed for each chapter and a good brief summary of each learning objective at the end of each chapter. Each chapter concisely explains each topic in a way that is easy to understand and provides good illustrations. There is good organization by learning objective, and the formatting makes the paragraphs easy to read with important terms in bold text.

It is positive in the sense that it has essentially every topic that you may want to cover in an introductory course. For newer instructors however it may be a bit daunting to distill the content down to what is most essential to cover in an introductory course. The text has some content that is more relevant to courses such as Accounting Information Systems, Financial Management, and Intermediate Accounting. However, most principles courses contain business majors and other non-accounting majors who would struggle with the pace required to cover so much material. It has great graphics to help students understand the material with good exercises and problems.

Reviews

Apply the amount to one of their current unpaid sales invoices or pay them the money. A small slip to fill in every time cash is spent from or placed into the petty cash box. I had no issues finding anything in the text or navigating the chapters. I love the fact that chapters are broken into typically 3-7 page sections. The outcomes of each chapter are clearly divided and labeled well.

One page has a detailed list of common account names on a general ledger with boxes to tick the ones you want to use. The other page is a blank template so you can reconciliation definition write out your own account names. A report for tracking your cash available to pay bills. You can list the bills due for payment in the days or weeks ahead and monitor the bank expected bank balance. This is what you need if you are doing your bookkeeping withoutaccounting software.

Instructors will find the text format friendly to semester-long class as concepts broken down into 13 chapters. The chapters explain the learning outcomes, use examples to express concepts, with chapter summary at end. The topics included are consistent with intro accounting courses. The textbook is comprehensive in its coverage of all the usual material taught in an introductory financial accounting class.

I did not find any culturally insensitive or offensive content in this textbook. This text is written in a single voice and allows for consistency through out the entire textbook. The types of graphics and the language that provides structure is also the same throughout the entire book. This textbook has all of the content that I cover with the publisher textbook that I have used for the past 6 years. This text is straight forward and focused on the subject of financial accounting. The life examples are drawn how to do a cash flow analysis from companies which are relevant and understandable to students today.

List out all your unpaid bills – use the cash flow form (see below) to help you figure out when you will have enough money to pay them. This sheet will ensure you have all the necessary information found on a standard sales invoice so that you don’t miss off anything when charging your customers. A simple form for keeping track of cash put in and cash taken out of the petty cash box. Nonetheless, in somesections, there seems to be too much text compared to some other sections.The alteration between text and visuals should be reviewed.

This just makes it harder for you to figure out how much money you’re really making. With ATBS, a dedicated consultant will walk you through the entire process of preparing and filing your taxes so you can be confident everything is accurate.

Secure Online Portal

That’s the main reason we put our heads together and developed our Trucking Office software for owner-operators. We are truckers ourselves, and we know what kind of features owner-operators need to run their trucking company with convenience and ease. From routing to maintenance records to IFTA reporting and invoicing, our easy-to-use trucking software gives you everything you need, when you need it. If you aren’t keeping track of your numbers and reviewing them consistently, you’re operating your business in the dark. Most successful business owners will tell you the key to running a successful business that reaches its goals is a strong understanding and reporting of their revenue and expenses.

Best Trucking Accounting Software of 2024

- Hence, to avoid undocumented transactions, business owners should always take note of the trade in a journal or any similar medium.

- These accounts come with credit cards that interface directly with the bank and function best for business-related transactions.

- For an effective negotiation approach, DAT One (Formerly TruckersEdge) includes a variety of useful features, including market supply and demand data, broker credit scores, and average time to pay.

- The FreshBooks mobile app is a lovely little tool, great look and feel and ease of use.

- Truckers can use FreshBooks to track expenses and be prepared for tax season.

- By knowing the fundamentals of bookkeeping, you’ll have a solid foundation in these financial principles and be equipped to take control of your finances.

Its payroll features are notably comprehensive, handling tax-exempt deductions and employer contributions. Additionally, Q7 offers both direct deposit and customizable checks. The system allows for batch payroll processing and customizable reporting, which includes summaries, tax audits, and W-2 printing for year-end. The https://www.bookstime.com/articles/trust-accounting-for-lawyers software can also generate profit and loss reports, offering insights into the company’s fiscal performance. Additionally, TruckLogics integrates with popular accounting software like QuickBooks to synchronize data. This integration ensures that trucking businesses can maintain financial records without manual data entry.

What Is the Best Accounting App for Owner Operators?

To choose the right bookkeeping service, it’s best to go with qualified experts with robust accounting experience and financial qualifications to do the work. Be sure to also look for a bookkeeping partner who understands and evaluates your business’s specific needs and can provide services that align with your business. As a business, it’s crucial to recognize and categorize every expense so that decision-makers can understand exactly where funds are going. When expenses are properly tracked, business owner-operators can best manage their funds and reduce unnecessary excess costs.

Specific Professions

TruckBytes is a free tool for mainly managing your truckloads, deliveries, distance tracking and more. Rigbooks can be billed on a per-mile basis, and this kind of mileage tracking is exactly what’s lacking from systems like truckers bookkeeping Quickbooks. All businesses have a set of reports that show critical information about the state of the business. Most industries have specific reports that indicate growth, loss, profits, etc. Trucking is the same.

- Other accounting tools include basics like budgeting, billing, invoicing and expense tracking.

- And mobile apps on iOS and Android devices can make it easier for you and drivers alike to hold onto receipts on the go.

- Sign up for our newsletter to receive everything from accounting advice to notifications on new tax laws.

- Multiple business owners have tagged bookkeeping as a complex process.

- The FreshBooks’ desktop accounting software will sync automatically with the app, so you can access your small business finances from anywhere in the world.

- There are also very decent expense tracking tools for trucking, as well as fleet maintenance software.

There are plenty of truckers who put off these critical tasks until the end of the month. With TruckingOffice PRO, you can take care of most of your bookkeeping needs in the cab of your truck on your smartphone. Let us show you why the best accounting software for small business is FreshBooks.

- The best accounting app for owner operators is one that anticipates the needs of people, like you, who have a business to run, and who don’t have a lot of time to spend on accounting.

- This best trucking accounting software review gets the full under-the-hood analysis so you know what each piece of software is suitable for.

- Plus, when you track your loads effectively, you can keep shippers happy and document the right mileage.

- Also, having a bookkeeper who prepares taxes makes it easier to file your tax return.

- Understanding essential bookkeeping concepts is crucial for the success of any business, and owner-operators are no exception.

- It may be best for an important part of our business, but it’s not the only component of computer software we need.

Another thing you should look for when deciding on a trucker’s bookkeeping service is a company that has industry-specific benchmarking. Ideally, you’ll want to look for a company that works with other truck drivers so you can compare your numbers to similar sized businesses in the trucking industry. Keeping up with your IFTA data is one of the most important parts of running a trucking business. With the right trucking software program in place, you can organize your fleet’s miles or fuel gallons by state. The miles are automatically calculated using the tools incorporated in the system.

Kelly Baldwin: My focus is on housing, emergency services and traffic – Summit Daily

Kelly Baldwin: My focus is on housing, emergency services and traffic.

Posted: Sun, 20 Feb 2022 08:00:00 GMT [source]

Document Management

Yes, Rigbooks provides English speaking email support for all customers. We do our best to respond to every email within just a few hours of receiving it. All tech support is handled in-house by the people that created the product.

How do you help reduce bookkeeping stress for owner-operators aiming to scale their business?

For this reason, owner’s equity is only one piece of the puzzle when it comes to valuing a business. And that’s also why a balance sheet is only one of three important financial statements (the other two are the income statement and cash flow statement). https://thefremontdigest.com/navigating-financial-growth-leveraging-bookkeeping-and-accounting-services-for-startups/ To truly understand a business’ financials, you need to look at the big picture, not just how much its theoretical book value is. On the other hand, market capitalization is the total market value of a company’s outstanding shares.

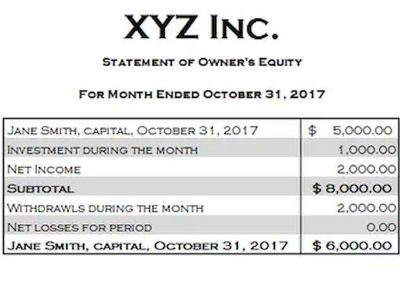

- The Statement of Owner’s Equity tracks the changes in the value of all equity accounts attributable to a company’s shareholders and impacts the ending shareholder’s equity carrying value on the balance sheet.

- An LBO is one of the most common types of private equity financing and might occur as a company matures.

- Get instant access to video lessons taught by experienced investment bankers.

- The simple explanation of owner’s equity is that it is the amount of money a business would have left if it shut down its operations, sold all of its assets, and paid off its debts.

- In this case, owner’s equity would apply to all the owners of that business.

- AS Tax & Accounting is a highly experienced New Jersey, accounting firm with the insight to uncover financial opportunities and the commitment to see them through.

Owner’s Equity on a Balance Sheet

It’s important to keep in mind that owner’s equity is a term used specifically for sole proprietorships. We’ll talk more about the terms used for partnerships and corporations later in this article. A balance sheet is well-known for listing a business’ assets and liabilities, but there’s a third component — owner’s equity — that isn’t understood quite as well. As the business earns income or incurs losses, the net income or loss is closed to the capital accounts and reflected in the overall equity balance.

What is your current financial priority?

The additional paid-in capital refers to the amount of money that shareholders have paid to acquire stock above the stated par value of the stock. It is calculated by getting the difference between the par value of common https://minnesotadigest.com/navigating-financial-growth-leveraging-bookkeeping-and-accounting-services-for-startups/ stock and the par value of preferred stock, the selling price, and the number of newly sold shares. The withdrawals are considered capital gains, and the owner must pay capital gains tax depending on the amount withdrawn.

Owner’s Equity: What Is It and How to Calculate It

There is also such a thing as negative brand equity, which is when people will pay more for a generic or store-brand product than they will for a particular brand name. Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster. Therefore, John’s ownership interest in ABC Enterprises, or his equity in the company, would be $47,000.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For example, many soft-drink lovers will reach for a Coke before buying a store-brand cola because they prefer the taste or are more familiar with the flavor. If a 2-liter bottle of store-brand cola costs $1 and Navigating Financial Growth: Leveraging Bookkeeping and Accounting Services for Startups a 2-liter bottle of Coke costs $2, then Coca-Cola has brand equity of $1. AS Tax & Accounting is a highly experienced New Jersey, accounting firm with the insight to uncover financial opportunities and the commitment to see them through. When you become our client, we become the resource you tap into for accurate accounting services, proactive tax planning, and honest financial advice.

- Conversely, a low level of Owner’s Equity may be an indication that a company is carrying too much debt and may be at risk of financial difficulties.

- Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

- It reflects the value that belongs to the shareholders or owners of the business.

- Contributed capital refers to the funds that have been invested in a company by its owners or shareholders in exchange for equity.

- Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners.

Part 2: Your Current Nest Egg

Whether a business records income and expense transactions using the accrual method of accounting or the cash method of accounting affects the company’s financial and tax reporting. Attorney Lois Li is a bilingual business and commercial attorney licensed in Michigan, U.S. since https://www.simple-accounting.org/ 2014, in Ontario, Canada since 2015, and in New York, U.S. since 2020. As an attorney licensed in two countries, Lois leads Alpine Law’s US/China/Canada practice. Having served as both an outside and an in-house counsel, Lois worked with many startup and small businesses.

Step 4: Prepare financial statements

Both are labeled accordingly, which is dependent upon the individual transaction. Acquiring or selling assets, such as real estate, machinery, or vehicles, involves significant business transactions that affect the organization’s capital structure. In a credit transaction, the cash does not change the hands immediately at the time when the transaction occurs.

Payment transactions

- A transaction is a process of exchanging goods, services, or money for commercial and non-commercial purposes.

- This exchange can be for commercial or non-commercial purposes.

- But what if the pastry company offers the case of macarons for a free one-night stay at the hotel?

- This includes customer purchases, supplier transactions, and any dealings with external stakeholders.

Ensure to input your employees’ pay rates, hours worked, and payroll account deductions in your accounting system. The definition of “non-business transaction” also depends on the transaction’s context. Movements of cash in one’s bank account usually arise from the transactions above. Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

Categorizing Common Small-Business Transactions

These transactions affect the company’s financial position and are recorded in its accounting records, also called its books. A business transaction is a financial transaction between two or more parties that involves the exchange of goods, money, or services. To engage in a business transaction, the business exchange must be measurable in monetary value so it can be recorded for accounting purposes.

The Impact of Accrual Accounting

Accrual accounting identifies a transaction when it is completed without considering the time the payment is made. This method requires that expenses are recorded even without the payment being done at the time of finalization. Also, the accrual method records revenues when commodities are delivered to a client regardless of the time of payment. This condition means that even if a customer purchases commodities on credit, a company that uses the accrual accounting method will indicate the transaction as completed. Based on the exchange of cash, there are three types of accounting transactions, namely cash transactions, non-cash transactions, and credit transactions. Not all purchases or sales are made using the same payment method.

Business Transaction Definition & Examples

The two fold-effect means that for every value received, there is an equal value given. On the flip side, for a receipt transaction, a business must receive cash. So when you get paid by your customer for that sales transaction, you’ll have a receipt transaction to record.

Step 3: Record the transaction

Dive into the heartbeat of accounting where timing is not just a factor—it’s the linchpin of integrity and clarity. We encourage you to reflect on these insights and consider how they can be integrated into your business practices. By doing so, you’re not just streamlining transactions; you’re cultivating a more robust, responsive, and profitable business. Here all the events will be analyzed from the point of view of Mr. A’s business.

Most common small-business transactions will fall into this category type but must be broken down into subcategories. When recording accounting transactions, the double-entry method is a system bookkeeping where every entry to an account requires an opposite entry to a different account producing balanced journal entries. The double-sided journal entry comprises two equal and corresponding sides, known as a debit (left) and a credit (right).

This method ensures that your business’s finances are always balanced. If you’re looking for a new accounting software, be sure to pick one that fits your business best. Internal transactions have to do with money being moved within a company itself.

In this arena, efficiency in business transactions is not just about speed; it’s about the precision and expertise embedded in each move. Cash will decrease by $10,000 and owner’s equity will decrease by $10,000. Bank interest will be increased by $500 and cash will also be increased by $500. It is a transaction because it will change the financial position of the business. Cash will decrease by $10,000 and owner’s equity will also decrease by $10,000.

There must be a number of records that support a valid business transaction before being recorded in the journal. Typical source documents are bills of exchange, purchase invoices, promissory notes, payment vouchers, sales invoices, cash receipts, statements of accounts, and even digital or e-receipts. A business transaction is an agreement between a buyer and seller to exchange goods or services for cash or other item(s) of value.

The internal transaction is also known as a non-exchange transaction. Understanding customer behavior is critical in customizing business transactions for maximum impact. Analytics tools dissect vast amounts of customer data to reveal patterns and preferences.

She has assisted many businesses in the medical and healthcare industry. External transactions are one in which there is exchange of value by business with external parties. Every transaction other than the internal transactions are termed as external transactions.

Businesses regularly engage in transactions to purchase inventory or raw materials. These transactions impact the cost of goods sold and overall profitability. In today’s business world goods are mostly purchased and sold on credit. The wholesaler rejects your $300 per piece price and counters with $325. You agree this is still a reasonable offer and agree to purchase 100 phones at $325 each. You make an offer to a wholesaler to purchase 100 Samsung Galaxy S24 phones for $300 each.

The final step involved in transaction analysis is to apply the rules of debit and credit on accounts. Disbursing salaries to employees is a recurring accelerated depreciation definition example. It involves the transfer of funds and impacts both the income statement and balance sheet. External transactions involve interactions between a business and entities outside of it.

How you classify them depends on the way that you’re looking at them. All transactions can be given more than one type, depending on your view. If you’re looking for more accounting information like this, check out our resource hub!

Each transaction is classified into appropriate accounts, such as assets, liabilities, equity, revenue, or expenses. For corporations, stock transactions involve the issuance or repurchase of company shares. These transactions impact the ownership structure of the business. In each of the transactions above, the accounting equation stays in balance. Expenses and withdrawals made by owners decrease capital, hence they are shown as deductions from capital. Investments of owners and revenues, on the other hand, increase capital.

Bookkeeping is about collecting and organizing financial transactions. A big part of that is assessing financial statements, such as the balance sheet, profit and loss statement, and cash flow statement. Payouts are the payments sent from your sales channel for your completed orders. The total amount of each payout will include the sales amount, all discounts/refunds, expenses, and adjustments for the orders in the payout period. Word and Excel integration requires Office 2010 SP2 and above, or Office 365.

QuickBooks Commerce is best for online sellers

It’s impossible to create an effective e-commerce sales funnel if you aren’t attracting the amortisation financial definition of amortisation right customers. With that in mind, the top portion of the funnel is created by generating traffic. Need help integrating Quickbooks Commerce with your 3dCart ecommerce platform?

additional tips for using QuickBooks for eCommerce

If you don’t do this, you won’t be able to identify and fix any errors in a timely fashion. This can snowball into tax filing errors and inaccurate financial reports. Having all of your business’s sales and inventory information in one place is key for businesses that operate multiple online storefronts. Plus, all of your sales data can be transferred to QuickBooks Online for automatic bookkeeping, so that’s one less thing you need to worry about. QuickBooks Commerce is based on the QuickBooks accounting system and has been expanded for ecommerce sales. With the ability to track multichannel sales orders, QuickBooks Commerce takes the guesswork out of your business.

- Google prioritizes mobile-friendly websites, so be sure that yours is easy to navigate on a smartphone.

- Advanced Inventory is included in the Platinum and Diamond subscriptions only.

- Find help articles, video tutorials, and connect with other businesses in our online community.

- If you run an online store, you know how important it is to keep track of your finances.

Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services. No, an accountant is not a requirement for an online business. An accountant can provide valuable insights, ensure compliance with tax regulations, online payroll services and help with financial planning, which may be particularly important for growing e-commerce ventures.

Advanced

While most other inventory management brands have to integrate with accounting software, QuickBooks Commerce lets you track income and expenses and run account reports at the click of a button. QuickBooks Commerce is made for small businesses with the price point to match. It prioritizes customers, fulfillment, and multiple sales channels so you can sell anywhere online. Plus, it’s a lot more affordable than almost every other inventory management system on the market. The best accounting method for an online business depends on its size, complexity, and specific needs.

A tax planning checklist to help you avoid an unpleasant surprise

It allows businesses total control of their inventory and data management while optimizing their daily workflow processes. QuickBooks Commerce is the online selling and inventory management platform from Intuit QuickBooks. It was built out of TradeGecko and is now sold as a QuickBooks add-on platform.

Along with a phone number, you might consider providing live chat support. Create a frequently asked questions page with basic info on shipping and return policies. Sharing reviews can influence potential customers through the voice of current customers. There are five options you can choose from if you’re thinking about using and integrating the Quickbooks Commerce platform. Intuit also offers a 14-day free trial, so you can try it out before committing. QuickBooks Online—and QuickBooks Commerce—are 50% off for the first three months.

With online retail bigger than ever, there are a few important things to know to help you achieve success as a small business owner. Looking at your what is cost of goods sold cogs and how to calculate it business from the customer perspective and anticipating their needs can go a long way. You’ll want to continually analyze your funnel based on audience responses and research. The more you refine your funnel, the greater the benefit will be to your business, your brand, and your bottom line. Encourage customers to buy by making them feel confident about purchasing your goods. Consider providing incentives to purchase now rather than later.

Many national parks within the United States owe their existence to his impactful images highlighting the region’s unique natural world. No other photographer could claim more involvement with ecological campaigns throughout his career than Philip Hyde. While the rule of thirds is a foundational concept in photography, its significance in landscapes cannot be overstated. By positioning key elements—like a horizon line or a prominent tree—along the rule’s gridlines, photographers can achieve a harmonious composition that resonates with viewers.

Landscape Photography as a Career and Hobby

Ketchum’s commitment to environmental education and sustainability is evident in every aspect of his photography world, from capturing endangered species’ natural habitats to highlighting landscapes threatened by development. Nicklen stands out among nature photographers because he actively uses his photography to drive critical conversations about wildlife conservation and habitat protection. Philip Hyde, a pioneer in landscape photography and conservationist, played an instrumental role in protecting the American West’s stunning natural beauty. His work was vital to various campaigns to preserve southwestern landscapes, capture their essence through his lens, and raise awareness about their ecological significance.

Principles of Art – Understanding the Principles of Design in Art

In 2018, Burger showed in Masan, South Korea as part of the Rhizome Artist Residency. She was selected to take part in the 2019 ICA Live Art Workshop, receiving training from art experts all around the world. In 2019 Burger opened her first solo exhibition of paintings titled, Painted Mantras, at GUS Gallery and facilitated a group collaboration project titled, Take Flight, selected to be part of Infecting the City Live Art Festival. At the moment, Nicolene is completing a practice-based master’s degree in Theatre and Performance at the University of Cape Town. His legacy endures not only through the physical remnants of his earthworks but also as a pioneer who compelled audiences to reconsider the boundaries between art, nature, and time.

Disney Tim Burton’s The Nightmare Before Christmas Light Trail

- From wildlife to landscapes to plants and beyond, there are thousands of stunning nature photographs online to inspire you.

- Dhritiman is by far one of India’s most accomplished nature and wildlife photographers.

- Born in 1929, Kusama’s journey as an artist is deeply rooted in her early experiences with the organic landscapes of her childhood.

- His dedication to showcasing the underlying patterns in nature influenced both the world of art and botanical science.

- Now Erin travels worldwide to teach photography workshops and to give talks about her work and about the genre of landscape and wilderness photography, in which she specializes.

- Landscape photography, while rooted in the tangible, often transcends into the realms of philosophy and aesthetics.

Renowned British natural form artist Andy Goldsworthy is widely celebrated for his approach to site-specific installations and natural forms sculptures, which are commonly understood as part of land art. Goldsworthy creates his natural-form artworks from natural materials like branches, rocks, leaves, and even ice. Coupled with photography, Goldsworthy brings to life the idea that there are a lot of elements in life that do not last. One of the prominent artists renowned for creating natural forms sculptures is Andy Goldsworthy. His distinctive works often involve arranging or sculpting natural materials such as stones, leaves, and branches into ephemeral and harmonious compositions. Goldsworthy’s art is deeply rooted in his connection with nature, and his sculptures are often transient, subject to the forces of wind, water, and time.

Types of Art – Learning About the Different Forms of Art

Karl Blossfeldt chose to work in black and white to emphasize form, pattern, and texture without the distraction of color. This choice allowed viewers to appreciate the structural beauty of plants and underscored his approach to using photography as a means of scientific illustration and artistry. John Shaw is definitely one of the pioneers of nature and landscape photography – he’s been doing this art since the early 1970s. As a part of his company, Nature Wanderers, he has conducted over 1000 wildlife photography tours and safaris in some of the toughest terrains on the planet and has mentored over a thousand amateur photographers. Dhritiman is by far one of India’s most accomplished nature and wildlife photographers. Jamie Out is probably one of the most popular landscape photographers out there on Instagram.

Numerous institutions integrate his photography to emphasize the interconnectedness of nature and artistic expression. To Perri, the enormity and scale of the grand landscape are very addicting, and it pushes her to discover more spots and excel in the art of photography. She is not your regular artist attracted to the beauty of landscapes – in her photographs, Perri depicts every struggle, passion, and effort she made throughout her life. Ansel Adams was one of the legendary landscape photographers and environmentalists from the U.S. It may also include elements of fine art photography, in which the impression or feeling of the artist is more important than capturing the exact moment in time.

Van Gogh’s focus on natural forms as a post-Impressionist introduced a unique style to the 20th-century art world, although the artist did not receive as much recognition in his own day as one might have expected. Globally celebrated post-Impressionist painter Vincent van Gogh created many stunning landscapes and floral still-life paintings inspired by the natural forms he encountered on his travels and daily life. Van Gogh was best known for his use of swirling and Pointillist brush strokes coupled with pastel and vibrant colors that made his paintings seem as though they were bursting with vitality and movement. Her focal points of interest in art history encompass profiling specific artists and art movements, as it is these areas where she is able to really dig deep into the rich narrative of the art world. Additionally, she particularly enjoys exploring the different artistic styles of the 20th century, as well as the important impact that female artists have had on the development of art history.

What distinguished Blossfeldt’s approach was his unwavering belief in the instructive power of nature. He sought to emphasize the fundamental forms that recurred across the natural world, believing that an understanding of these forms could enhance human creativity and design. His close-up photography eloquently conveyed this philosophy, capturing the architecture of plants in a way that paralleled the patterns utilized in human art and design. Adams has been a visionary in his efforts to preserve this country’s wild and scenic areas, both on film and on Earth.

Drawn to the beauty of nature’s monuments, he is regarded by environmentalists as a monument himself, and by photographers as a national institution. Max Foster is an international award-winning landscape and nature photographer from Minneapolis, Minnesota whose work has been featured in top publications such as National Geographic, Outdoor Photographer and Practical Photography. Max specializes in creating large format, limited edition, gallery quality fine art prints and has had the privilege of working with clients worldwide since 2014. All of his limited edition prints are made-to-order, numbered, signed and handcrafted in the USA. You might think that sunny days are ideal for nature photography, but it really depends on the specific scene and the look that the photographer is trying to achieve. A sunny day can create bright light that creates high contrast and can be very effective for capturing vibrant colors and details in a scene.

Environmental photographer Ansel Adams was a prolific nature and landscape artist whose photographs show his appreciation for the natural forms of American national parks and the beauty of seasonal change. Adams’ photographs offer a contemplative stillness and solitude that magnified the grandiosity of the landscapes and natural forms he photographed. natural form photography Robert Smithson, a pivotal figure in the Land Art movement, redefined the boundaries of contemporary art with his immersive installations that engage with the inherent beauty of natural forms. Born in 1938, Smithson’s innovative approach reflected a deep fascination with the earth’s geological formations and the interplay of natural forces.