It is very crucial that you observe that brand new LTV percentages set call at this type of Legislation is the limitation deductible. Properly, home mortgage company would be to adopt even more conservative LTV percentages where the underlying risks during the credit markets or avenues of your lending markets is high.

Credit decisions shouldn’t be centered entirely toward safety available and is very important you to loan providers dont believe in the latest LTV as an option to examining cost capabilities. Mortgage loan business must ensure that suitable processes and functions was set up to fully capture which risk. 5. Energetic Collateral Government

Mortgage loan team have to has actually sufficient inner chance management and you can collateral administration processes inside locations that be certain that possessions appraisals try sensible and you can corroborated. Possessions assessment records shouldn’t echo asked coming domestic price appreciate.

In advance of people irrevocable commitment to give an independent towards the-website valuation of the house must be undertaken from the a specialist alternative party that is suitably certified and you may independent of the borrower, merchant, developer/builder as well as the loan decision process.

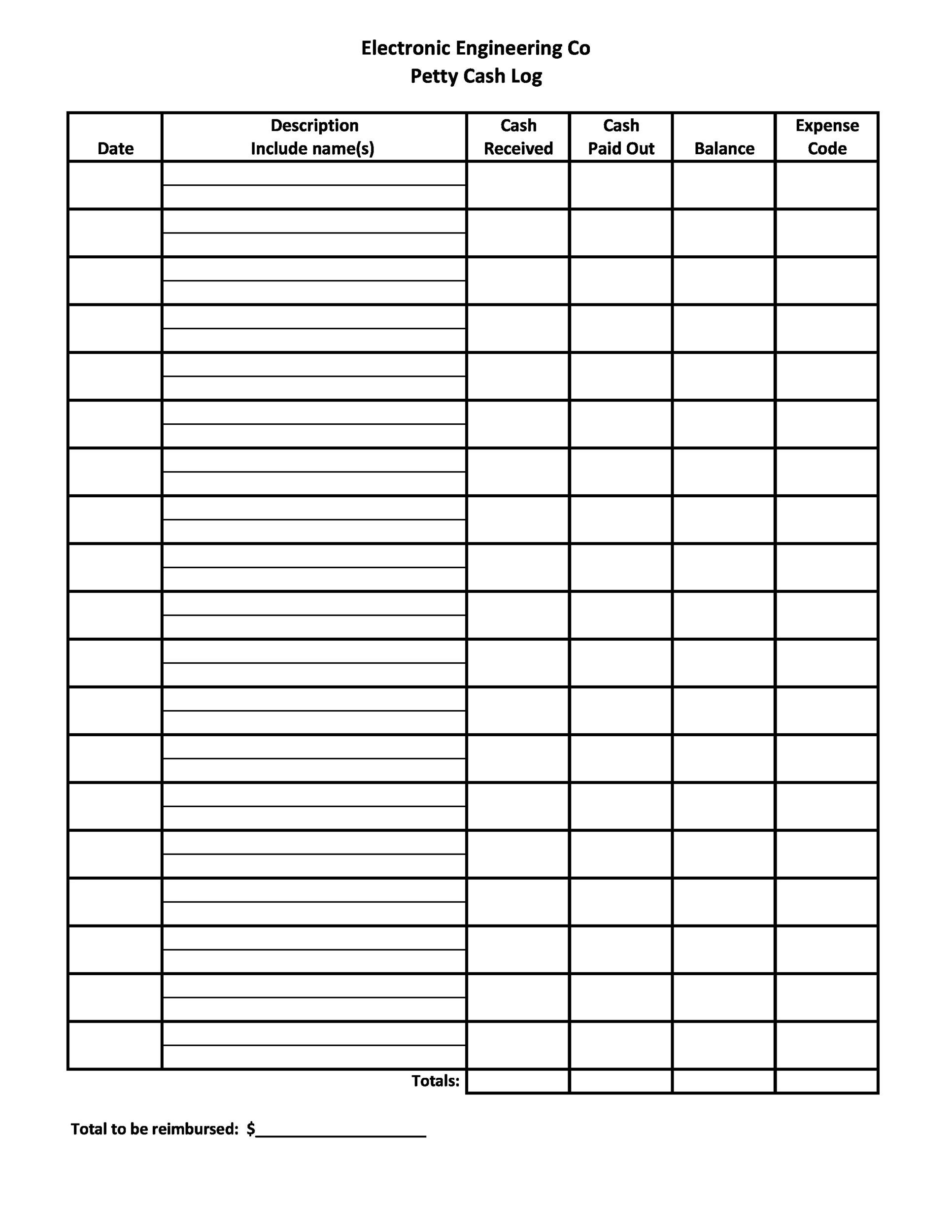

The most Loan to Really worth (LTV) proportion are listed below:

Centered on obvious comparison criteria, for each and every lender and finance company must have in position a section recognized a number of independent Valuers.

Every court titles should be clear of encumbrances and you will consist of zero road blocks towards the registration of security welfare. When it comes to homes talented so you can UAE Nationals confirmation of brand new present out of sometimes The appropriate Diwan, otherwise Construction System, in addition to verification regarding land company needs. 6. Due diligence

In order to limitation and you can mitigate the chance due to home loan funds business, home mortgage business need in place a clear created program of research (courtroom and other) to-be then followed throughout the all grade of the application technique to be sure credit principles are increasingly being implemented precisely. Measures must be in location to guarantee that, prior to drawdown, most of the requirements tying toward mortgage was basically (or are increasingly being) complied having.

Blog post (3): Crucial Rates

- step one. Debt obligations Ratio (DBR)

Maximum DBR welcome is decided call at Legislation Of Loans from banks or any other Services Accessible to Private Customers- we.e. 50 percent regarding terrible income and you will people typical earnings of a good laid out and you can specific supply at any time’. What is very important although not whenever and also make a review of your borrower’s capacity to pay, loan providers dont instantly use maximum DBR or take under consideration the specific affairs of your own borrower and exposure into establishment.

In the visiting the latest DBR, real estate loan team have to be concerned attempt the borrowed funds at the (2 to 4) percentage facts over the current interest rate to the mortgage, based upon what peak rates has reached about duration. In which an introductory rate of interest enforce the stress take to might be carried with reference to the interest rate that will pertain toward cessation of your basic price.

In which the house is for resource aim real estate loan team are required to create a beneficial deduction with a minimum of a few months’ local rental income throughout the DBR formula to evaluate the brand new borrower’s ability to repay taking account from low-local rental attacks.

Where the mortgage repayment agenda expands not in the requested retirement age, home loan business are required to make sure the harmony the at the time is are maintained at good DBR away from 50 % of the borrower’s blog post old-age income. 2. Financing to help you Really worth Ratio (LTV)

- a great. Worth of Assets quicker or equal to AED 5 2000 bank loan mil – restrict 85% of your worth of the house.