- EMI CALCULATOR

- Eligibility CALCULATOR

- Harmony Transfer CALCULATOR

- STAMP Duty CALCULATOR

- Tax CALCULATOR

- Home loan Quick Reads

- Ideas on how to Submit an application for A home loan

- Mortgage Taxation Gurus

- CIBIL Get Computation

Home loan towards the Rs. twenty-five,000 Salary

Nowadays, availing construction funds is probably the most needed-once capital provider for homebuyers of every earnings slab. Yet not, inspite of the benefits which makes casing available for all, some aspiring Mortgage people have appropriate concerns about protecting housing credit towards the modest wages regarding Rs. 25,000 a month. So, if you’re wondering exactly how much Financial you could get out of with the an effective Rs.twenty-five,000 paycheck, read on knowing far more.

How much cash Home loan Can one log on to a Rs twenty five,000 Paycheck?

Very lenders often have a minimum earnings requirements. The lender and lender possess a unique advice and you will guidelines on calculating the qualified loan amount each candidate. It is mainly determined for the monthly income in a way that this new EMIs never cross 40% so you’re able to 50% of earnings.

Just like the a thumb laws, one can possibly score property loan as much as sixty moments the monthly earnings. However the genuine amount of housing loan relies on some other elements as well, like the town of home, age of the newest candidate, established financial obligation and. Loan providers make a firm decision the correct amount of cash they are able to provide to each customers according to the comparison and confirmation monitors sent aside while in the Mortgage processing.

Mortgage Count into a month-to-month Salary out of Rs. twenty five,000

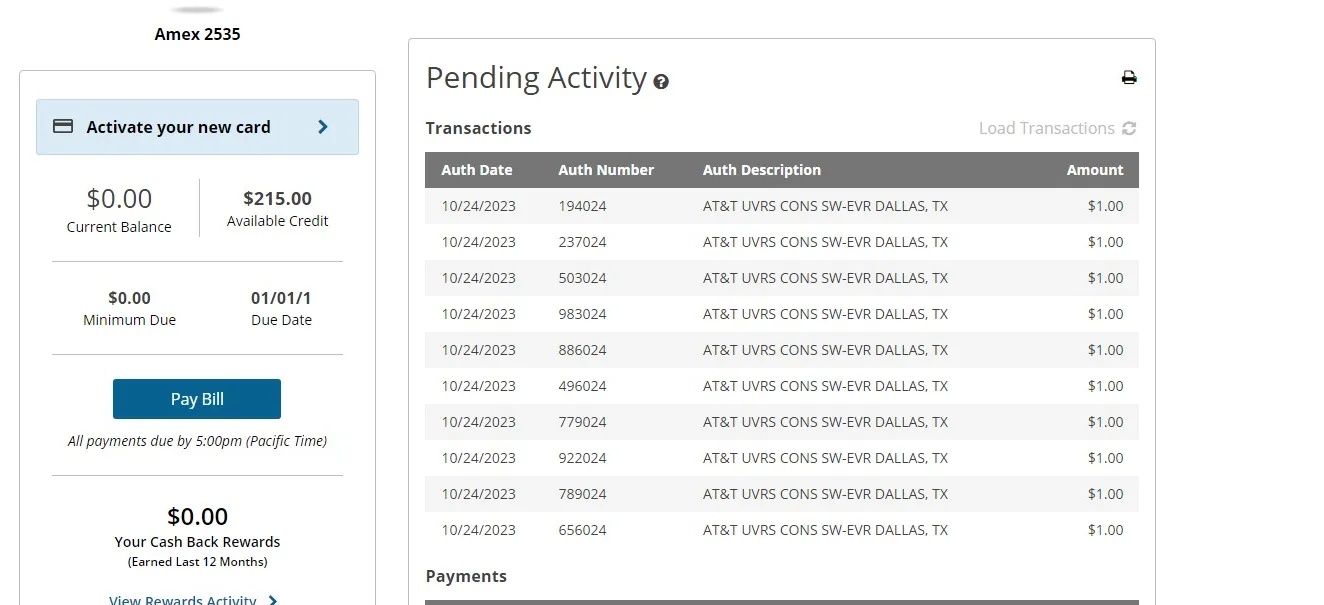

Given just below was a desk that give an instant have a look at the fresh new estimate Home loan count you can receive facing your own paycheck:

Nevertheless, make the assistance of a houses mortgage qualifications calculator to check on the amount of cash you are eligible to use. This will allow you to package your residence mortgage inside an effective and you will troubles-100 % free trend.

Qualification Requirements to possess Choosing a home loan into the Rs. 25,000 Salary

If you’re looking to own home financing to your a paycheck regarding Rs. twenty-five,000, you ought to meet a number of important criteria particularly:

**The top of age maximum is generally accepted as many years at that time out-of mortgage maturity. At the same time, top of the years maximum to possess applicants was subject to change, according to possessions profile.

Calculation regarding Financial Eligibility

Their qualifications to own a home loan is dependent on numerous issues by which lenders is also determine good borrower’s payment potential together with credit exposure involved. These include:

Earnings and you will A job Character

Loan providers normally give favorable deals to teams of recognised people and you may those individuals buying centered business ventures. A premier income indicates ideal repayment capacity with lower possibility of standard, thereby allowing you to negotiate aggressive interest rates.

Period of Candidate

Securing money at the beginning of your work can bring you high-value money which have longer tenors. The price of credit stays within this sensible limits compared to the the new borrowing from the bank will cost you of them drawing near to the end of its provider ages.

Borrowing Profile

Their borrowing from the bank character was a variety of numerous considerations such repayment online personal loans Illinois record, borrowing from the bank designs, credit utilisation, debt-to-money ratio, borrowing from the bank combine and much more. The credit score sumeters in the way of good CIBIL otherwise credit rating. A high rating denotes a reduced-chance profile granting the advantage of preferential interest levels and you may conditions.

How to Submit an application for a mortgage into the Rs.twenty-five,000 Income?

Here is a step-by-step publication on how you can sign up for a home loan towards a paycheck from Rs. twenty five,000:

How to Boost My Eligibility getting a mortgage?

Before you apply for a loan, be certain that your qualification very first incase requisite, take corrective strategies to enhance it to have shorter approvals with this productive tips:

Use with a beneficial Co-Applicant

Trying to get a joint loan with an excellent co-candidate, that a premier income and you can credit score, increase qualifications together with ensure private taxation gurus getting both borrowers.

Choose an adaptable Tenor

An adaptable tenor splits the full payments more than an extended cycle, turning down the newest EMIs. It does increase loan qualification and work very well for those with tight budget offer. Furthermore, having fun with a mortgage EMI calculator will enable you to pick suitable payments and you may tenors as per your own salary.

Talk about every Sourced elements of Income

Identify almost every other income supplies of trying to boost qualifications, such leasing money, production away from investment, variable spend such as for example annual incentives, an such like. you to complement your own income.

Obtaining a reasonable estimate of the property Loan amount you can borrow against their salary of Rs. 25,000 will help you to discover property into the qualifications range, rescuing work-time and energy when house browse. Like that, you are free to choose a property that meets the priorities and you may their pocket, and also safe property loans profit instead pushing your finances. *Conditions and terms apply.